Economy

Global investors call for guidelines for sustainability disclosure

The Investor Network on Climate Risk (INCR) has produced a consultation paper that would force firms listed on global stock exchanges to reveal their environmental, social and governance (ESG) strategies in their annual reports.

The INCR is a network of institutional investors led by Ceres, includes the likes of Blackrock, F&C Investments and Deutsche Asset Management.

Clubbing together with NASDAQ OMX, the INCR wants companies listed on US and global stock exchanges to be more transparent about their sustainability activities.

“While several exchanges have adopted their own sustainability listing requirements and guidance, INCR members and NASDAQ OMX have set out to develop a uniform baseline standard that all stock exchanges can use”, the proposal says.

Once investors have provided feedback, the document will be submitted to stock exchanges to be reviewed and then handed to the World Federation of Exchanges for its annual meeting.

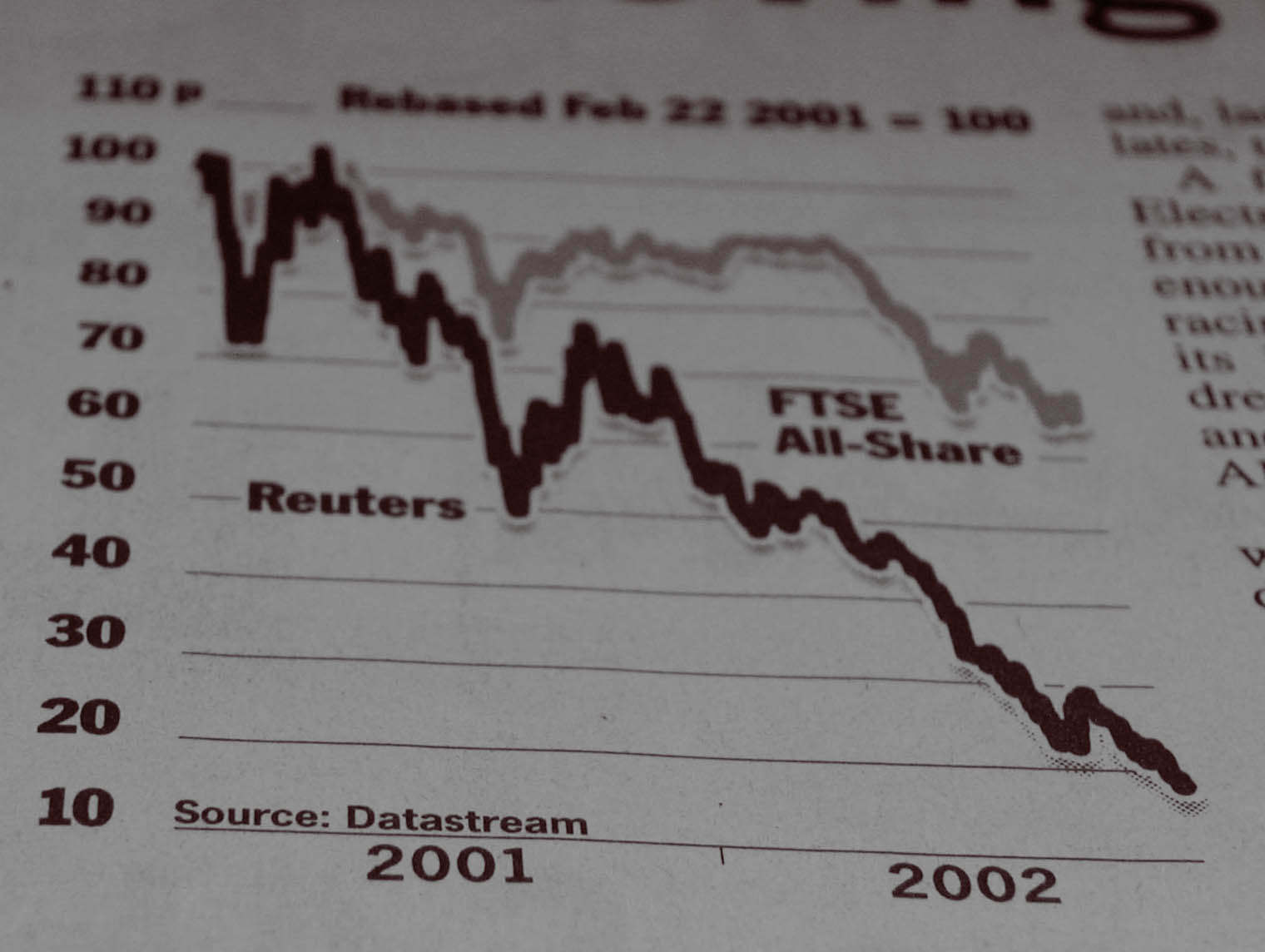

Earlier this month, FTSE launched the Environmental Technologies Index (ET 100), which aims to assess companies operating within environmental markets, such as firms involved in renewable energy, water, energy efficiency, waste management and pollution control. Thomson Reuters launched a similar index around the same time in an effort to evaluate the sustainability performance of major global benchmarks.

Research by the Environmental Investment Organisation (EIO) found that BT, Vodafone and AstraZeneca performed the best in a new carbon ranking system that measures firms’ greenhouse gas emissions and disclosure.

Further reading:

FTSE launches new environmental index

Dow Jones launches ‘first’ sustainability index for emerging markets

FTSE 100 firms reporting less financial data since 2008 crisis

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future