Economy

Citi, Morgan Stanley and Bank of America top funders of coal, says report

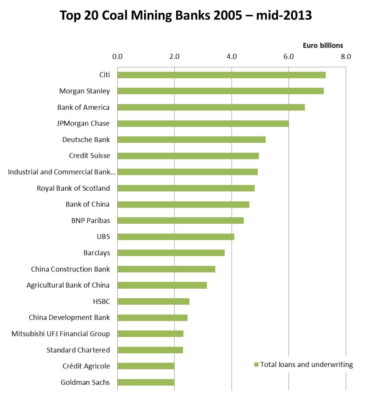

Citi, Morgan Stanley and Bank of America have topped a new ranking of commercial banks on the extent to which they finance coal mining projects. The trio have collectively pumped over €21 billion (£17.6 billion) into the industry since 2005.

According to a new report by a coalition of European non-governmental organisations, while 89 banks have funded coal projects to the tune of €118 billion (£98 billion) in the eight years to mid-2013, the top 20 funders account for 71% of this. This equates to around €83.8 billion (£70.1 billion).

Banking on Coal, by campaign groups including BankTrack, Urgewald and the World Development Movement (WDM), adds that since 2000, coal production has grown by 70%. This is despite it being among the most polluting fossil fuels.

“Coal is killing the climate, and banks are fuelling the boom”, said Nick Dearden, director of the WDM. He added that any hopes of limiting the global average temperature increase to 2C – the threshold agreed by governments – will be a “fantasy” while banks continue to fund the coal industry at current levels.

Analysis by the Carbon Tracker Initiative suggests that the majority of current known fossil fuel reserves – somewhere between 60-80% – is classified as “unburnable” if the 2C warming limit is factored in.

“One of the ways in which investors are beginning to get their arms around [carbon] is to do some more sophisticated analysis of what the spectrum is, and then pick off the more extreme parts of it”, said Seb Beloe, head of sustainability at WHEB Asset Management.

“Given where we are with the science around climate change, and indeed even the policy that is being developed in response to it, you have to be pretty brave or pretty foolhardy to believe that things aren’t going to get tighter for that most extreme end of the carbon spectrum over the next 10, 20 or 30 years.”

He added, “It may feel like today these are legitimate investments, but in a way that’s not the question you should be asking. The question is whether or not they will continue to be legitimate in 10 years, let alone 30 years. We think that prudent, risk-averse investors will absolutely think twice before they invest in those sorts of assets.”

Mark Hoskin, a partner at London-based financial advisory firm Holden & Partners, said there were a number of reasons for why the finance world continued to fund fossil fuels. These include: investors not being fully aware of the long-term financial impacts of climate change; the “unsophisticated” financial models currently in play; and what he called a “sheep mentality”, where governments and communities want fossil fuels today and if banks and investors do not help finance this, somebody else will.

“The undeveloped world has an insatiable thirst for energy as it tries to improve the quality of life of its populations”, Hoskin said.

“Fossil fuels are the only short-term solution to give it sufficient power, fast enough to drive its economies forward and to help develop its communities. International action on the price of carbon has not been solid enough to alleviate this problem.

“The amount of money pouring into equity markets and from banks clearly demonstrates that the investment community does not believe that climate change will alter the value of carbon assets within the timeframe of their investment horizons.”

The Banking on Coal study places four UK banks in the top 20 most prolific coal lenders and underwriters in the world: the Royal Bank of Scotland (eight), Barclays (12), HSBC (15) and Standard Chartered (18).

Yann Louvel of BankTrack, who analysed the banks’ policies on coal financing, said, “Banks finally need to face up to the real-world impacts of their financing decisions. When they finance companies that blow up mountaintops or destroy jungles to extract coal, they have a responsibility for these impacts.”

Further reading:

Investors worth $3tn put pressure on fossil fuels industry to rethink future

The other reason for divestment

Pension headache: why we need our funds to go on a fossil fuel diet

‘Urgent action’ required to protect pension savings from climate change

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future