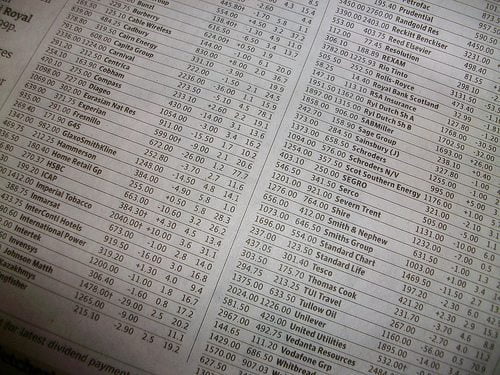

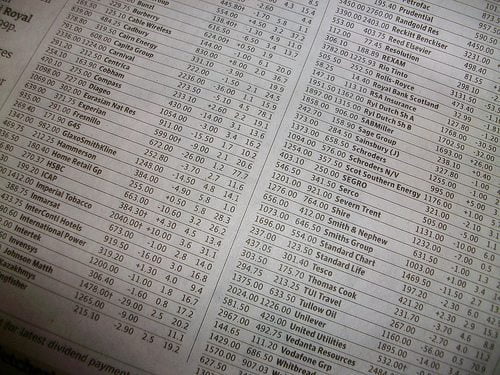

Economy

Fewer financial projections by FTSE 100 firms in wake of 2008 crisis

FTSE 100 companies lack the confidence to commit to financial projections after the 2008 crash, a new study has revealed.

Research by analysis consultancy Metapraxis shows that that the volume of forward-looking financial data included in annual report statements has decreased by a third since the financial crisis that led to the demise of investment bank Lehman Brothers five years ago, despite calls for more transparency on company performance.

Metapraxis studied the annual reports of FTSE 100 companies between the years 2006-2012 and measured the quantity of financial and non-financial data provided in the business reviews included in the statements of chairmen and CEOs. It found that the volume of forward-looking information decreased by 24% – the sharpest decline to date.

The reductions in available financial information were most prominent in three sectors: telecoms (down by 85%), basic materials (down by 74%) and consumer goods (down by 43%).

Simon Bittlestone, managing director at Metapraxis, said, “With the economy starting to recover, it is important that FTSE 100 firms lead by example and start providing better information to shareholders.

“Organisations need to improve management information to support better decision making. Those companies that feel confident enough to provide forward-looking financial projections generally have better internal management information and greater visibility of future performance.

“This increased transparency gives shareholders confidence that management is fully in control of the business.”

Further reading:

Directors enjoy “platinum-plated” pensions, TUC claims

Financial returns from ethical investment funds ‘better than mainstream’ in last 12 months

What the FTSE 100 may look like when William and Kate’s child is 14 years old