Economy

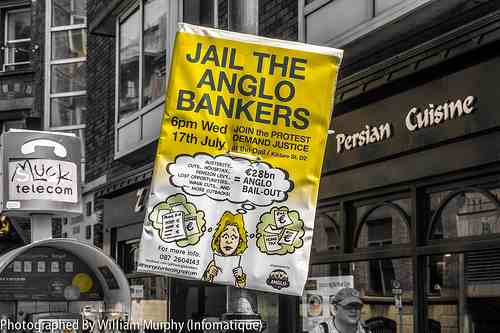

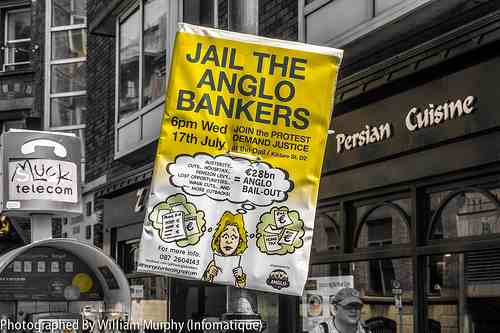

Government announces criminal punishment for reckless bankers

Amendments to the banking reform bill will introduce higher standards of conduct for bankers and additional measures to protect customers from banks’ failures.

Under draft legislation, which is on its way to the House of Lords, the Bank of England will be responsible for supervising the bank sector, to better guard taxpayers and customers from the mistakes or failure of banks.

The 86 amendments aim to enhance competition and create a bank system that “works for the costumers”. It also introduces tougher measures for senior bankers guilty of reckless misconduct, considering up to seven years in jail and unlimited fine for the most serious offences.

A Treasury spokesperson said, “We are determined that the government’s reforms to the banking sector deliver a stronger and safer financial system that supports the British economy, businesses and consumers.

“Today’s amendments mark the final part of the government’s plan for the biggest ever overhaul of the UK banking system. Already we have put the Bank of England back at the centre of prudential supervision and now, through the banking reform bill, we are delivering on our promise to increase competition, drive up standards and increase financial stability.”

In June, the parliamentary commission on banking standards outlined measures to tackle banking malpractice, in the wake of the 2008 financial crisis and the Libor scandal in 2012. It suggested that the threat of prison sentence for bankers would have given them “pause for thought” before acting in an irresponsible way.

However, the Law Society later argued that sending bankers to jail would have stifled economic growth and excluded qualified banking professionals from the top jobs.

Further reading:

Jailing bankers for misconduct not the solution, says Law Society

‘Shocking and widespread malpractice’ should land bankers in jail, says commission

One responsible banking system to rule them all

Environment11 months ago

Environment11 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features10 months ago

Features10 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features11 months ago

Features11 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy10 months ago

Energy10 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future