Economy

Introductory and closing remarks to the Sustainable Investment Bootcamp

On Thursday September 26, in the spectacular Old Hall of London’s Lincoln’s Inn, 47 financial advisers from 43 firms listened to three inspirational speeches, from the exceptional Will Day, Julia Dreblow and Michelle Hoskin, and two panel discussions of leading funds and advisers, hosted by Mike Scott and Raj Thamotheram. Our publisher, Simon Leadbetter, opened the event.

Thank you for coming to Blue & Green Tomorrow’s first event – the Sustainable Investment Bootcamp. I want to thank you all for coming, and thank our speakers, panellists and those who have supported the creation of this event.

I can’t let the moment pass without mentioning this incredible Old Hall, originally built in 1489. The Inn itself is believed to be named after Henry de Lacy, Earl of Lincoln, and chief counsellor to Edward I. The Inn is alma mater to four British prime ministers, including Margaret Thatcher, as well as lord chancellors, foreign chief justices and presidents. Blue & Green Tomorrow came to life in the City of Lincoln and our core team of writers, including the editor, are graduates of that city’s exceptional School of Journalism. It seemed natural that we should hold our first event in the hall that bears the name of that cathedral city.

Financial trade in all its forms outstrips the sum of global output, or GDP, 26:1.

That means for every single pound of real world economic activity, £26 is traded in shares, derivatives and currency. Investment, more than any other human activity, shapes our world. It creates the quality of life and standard of living in the communities, countries and world we live in and will pass on to our children. It was these staggering ratios that led to the birth of Blue & Green Tomorrow.

We recognised that the real solution to many of the world’s seemingly intractable problems lies in making investment, more sustainable, more socially responsible and, more ethical. My background is financial services and the media – Blue & Green is the fusion of those two disciplines. Telling interesting stories about what we believe to be the most interesting area for investors – sustainability.

Every day we write about sustainability: yes investment at the core of what we write, but also responsible travel, ethical spending and clean energy. We don’t preach (either to the converted or unconverted). People are time poor and don’t want to be lectured at. Confrontation never works.

We don’t believe there is only one solution or one way of thinking about these issues. We want to engage them in the debate. We unashamedly target the wealthiest through what we write about, because they’re the ones who can make the biggest difference with how they invest and spend. We are fair, optimistic and responsible; free to access, we rely on the support of many generous organisations who fund our magazine.

Our primary role is to amplify the message of those working in sustainability. The scientists, entrepreneurs, corporations, institutions, intermediaries, politicians, charities and of course, the individuals.

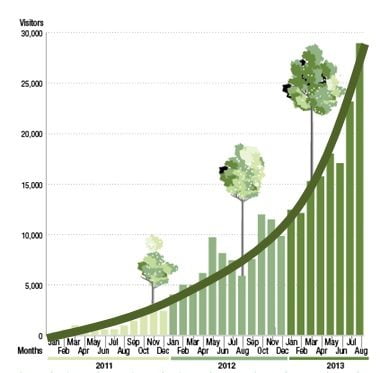

Click to enlarge.

And we’re not just growing exponentially and organically. Our recent acquisition of Worldwise Investor, (which has been rebranded as Blue & Green Investor) means we have now created a unique platform to connect a rapidly growing number of investors with advisers and wealth managers, and them with investment opportunities. Blue & Green Tomorrow for every investor. Blue & Green Investor for sophisticated investors and financial professionals.

So why sustainability and investment?

Sustainability is first cited in 1845 as a quasi-legal term that means defensible. Is your legal argument sustainable?

“Sustainable” in the sense of “being continued viably”, was then used in the context of international development. It was more about helping the developing world, develop, in a viable fashion. Investment that ran parallel to this field has more traditionally used the term ethical or socially responsible investment.

Today sustainability has come to mean: conserving an ecological balance by avoiding depletion of natural resources. Today you may hear terms such as triple bottom line; environmental, social and corporate governance; socially responsible investment; green investment; and impact investment.

But they all circle back to one central thought. Sustainable investment means investing in a way that is capable of being continued indefinitely. That balances the needs of the planet we live on, its people and all of our prosperity. The question we have to ask is, is the way we invest and what we invest in capable of being continued at their current levels? Are they defensible?

We live in a period of enormous volatility, uncertainty, complexity and ambiguity. Climate change, deforestation, polar ice melt, desertification and biodiversity loss. We are polluting the air, sea and land in a way, which is literally killing us. We’ve even managed to pollute space with debris, threatening vital communication satellites. Global population is rising. Fossil fuels are at their peak and we can’t even burn the reserves we have. We’re running out of vital resources, one of which is the most fundamental resource for life – fresh water. Many of these issues will be spoken about today but I won’t dwell on them.

Today we will not be handwringing about these problems, but exploring the solutions and opportunities that they create. Pollution, resource scarcity, population growth, over consumption and environmental degradation threaten our way of life. Yes, these create significant environmental, social and economic threats.

These aren’t the paranoid obsessions of, in the words of George Osborne, some “environmental Taliban”. They aren’t the dogma of, in the words of environment secretary Owen Paterson, some new sort of evidence-based “religion”. And they certainly aren’t the work of socialist econazis. Thank you to James Delingpole of the Telegraph for that particularly pleasant epithet.

Well-known sandal-wearing, muesli-knitting, eco-warrior lefties at institutions such as OPEC, the CIA, the US Department for Defence and the Oil & Gas Journal see these as clear and present threats to prosperity and global security.

This is what we think. Smart investment and sensible capital now recognises these risks. The past period of steady yet unsustainable growth is no guarantor of future performance. Quite the opposite, in fact. Smart investors and sensible capital understand that every major risk or problem creates an attractive and juicy opportunity for innovators and their investors

We know innovation equals growth and prosperity. It’s the only thing that ever does. Competition, disruption, fast-success and fast-failure from emerging technologies and new ways of thinking drive out the old, bringing choice, efficiency and prosperity

If the 18th to early-20th centuries were the disruption of the Industrial Revolution, and if the 20th century was the disruption of the Information Revolution, then the 21st century will see the disruption of the Sustainability Revolution, which heralds the limits of polluting, inefficient and harmful growth.

Sustainable innovation in clean energy, energy efficiency, sustainable consumption, mass high speed transport, sustainable agriculture and water treatment can mean sustainable prosperity. Getting our largest companies to embrace this revolution is key, too – they are not the enemy, but part of the solution.

This is where investment is going in the 21st century. This thinking will create the fast growth industries of tomorrow. This is where we can capitalise on the UK’s natural gift for innovation and use of capital. It will allow us to create world-beating industries and valuable exports in goods and investment. If we lead the world, we will guarantee energy security where we don’t need to import scarce commodities, at volatile prices from unstable or unsavoury regimes, just as our relative global purchasing power is diminishing.

Here are the facts.

The sector is already huge. Twenty-two per cent of all assets invested globally are done sustainably. We in the United Kingdom already lead this sector – but others are catching up. The sector is profitable – with ethical funds out performing their conventional (some would say unethical, unsustainable and irresponsible) peers. The wealthiest investors are making this an ever greater part of their portfolio. Follow the money. And three-quarters of financial advisers get requests for ethical financial advice – which suggests the problem is supply not demand.

And here’s the opportunity for financial advisers.

You can engage clients on a number of issues. Aligning an investment portfolio with their values and beliefs – surely the essence of good financial advice; investing in the most innovative and sustainable companies – the fast growth industries of the future; helping them use their investment to change the least sustainable companies – a company’s pollution, waste and inefficiency means lower profits and more volatile returns – and possible sanctions or a public backlash that will harm value; helping the developing world with investment, rather than trade or charity – making an impact by building other country’s economies and self-sufficiency; and creating global stability through prosperity.

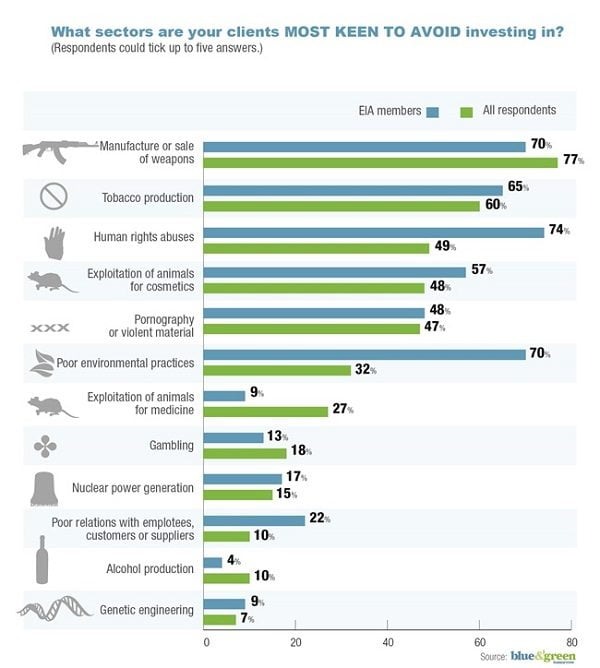

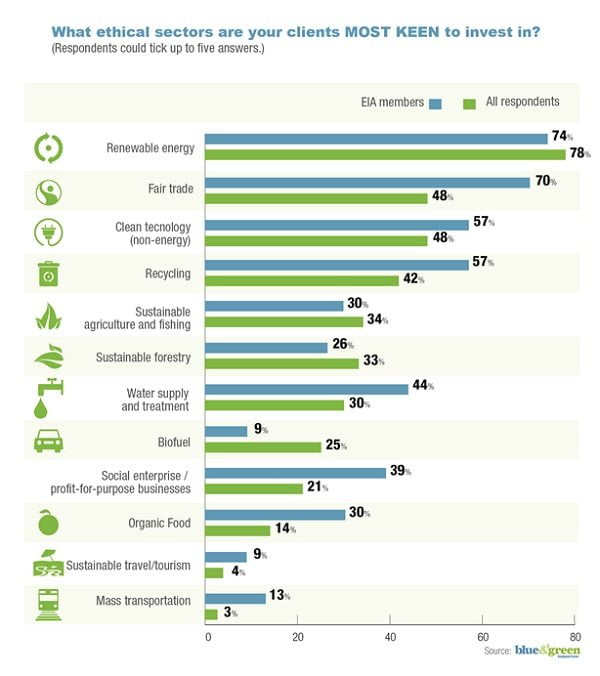

Every year we survey financial advisers to get a state of the advice space generally and sustainable investment space specifically. This is what those 74% of advisers who get requests for ethical financial advice say their clients avoid investing in and those they choose.

These are the conversations to have, broadening the discussion from investment income or growth, but what they value and believe.

These are the conversations to have, broadening the discussion from investment income or growth, but what they value and believe.

Another reason to get on top of this sector. The average age when people start investing is 42 (for comparison, the average age for a first time buyer is now 37). Just over half the population is under 40 – and they are tomorrow’s investors.

Today’s average investor has not lived their entire life in a digitally connected, environmentally-conscious world. The average investor tomorrow has. Opaque, complex and unsustainable products don’t cut it with tomorrow’s investors.

That digitally connected, environmentally-conscious group is only now entering the investment space. We conservatively estimate that they have £573 billion pounds to invest. Connected to the whole Earth’s information by the internet – recycling, climate change and human rights are the norm.

At the click of a mouse or slide of a finger, they can see the real world effects of what they invest in, and which institutions and companies are doing the greatest damage. They also publish good or bad experiences, to friends and their parents and grandparents. To your current clients.

Fundamentally, we’re optimistic.

Human ingenuity and creativity means we will ultimately address the problems we face. It would just be cheaper and less painful to address them today.

This is not an issue of left-wing or right-wing. Free markets and trade have lifted millions out of poverty – we just need to make them fairer. This is not an issue of green or anti-green. Who doesn’t want to preserve the environment and protect the human?

This is simply about what is sustainable and what is not.

The people who will speak today are not idealists, with some romantic notion of a better yesterday. It’s one of the most impressive groups of people I’ve ever seen at an event of this kind. They are not pessimistic bunch either. They are inspiring thought leaders, fund managers and advisers, who want investment to generate serious growth and income. But also our children to prosper in a clean, stable, sustainable world. To adapt a proverb, we don’t inherit the Earth from our parents but borrow it from our children.

Politicians argue rightly that leaving significant national debt from one generation to the next is unethical. We would argue that living and investing unsustainably, leaving a heavily polluted, thinly resourced, and unstable world behind is equally unethical, if not more so.

Today we will explore some of the facts, the misinformation, investment approaches and the experiences of current advisers so you can help your clients make more informed choices about what they invest in. We hope you enjoy the day.

Welcome to 21st century investment.

Closing remarks

Well there we go. Whatever you believe about the issue and causes of climate change no one can doubt the global risks of pollution, resource scarcity, population growth and environmental degradation. But risk creates opportunities. Especially, for those who wish to solve them in a sustainable way. The smartest investors and those deploying trillions in capital understand this

Fundamentally this comes down to two things – invest in the most sustainable and make the unsustainable sustainable.

Investment risk used to be measured based on past performance, but we all know past performance is no indicator of future performance, as waves of volatility, uncertainty, complexity and ambiguity hit us, they will create the greatest future risk for unsustainable governments, institutions, companies and investors.

And here’s a final snapshot of the main problem and why this boot camp matters. Before I launched Blue & Green Tomorrow, I visited three financial advisers and told them I had considerable (vast) inheritance to invest ethically, responsibly and sustainably. Regardless of my clearly expressed opinion that I wanted to invest in this way, each one determinedly tried to put me off.

Financial services, and investment specifically, can make the world significantly better, or it can make it significantly worse. As advisers, you play a vital role in helping your clients make informed choices to invest in a better world. Today, we’ll give you the information to discuss sustainable investment with confidence – or to know where to go for answers. The problem is not one of demand for sustainable investment, but a supply of accurate information and well-informed advice

Blue & Green Tomorrow is fast becoming the magazine of record in sustainable investment. We publish 15 or more articles a day and 18 accessible guides a year on every subject related to sustainability. Please read us and download the guides and feel free to use them with your clients.

Which leaves me to say thank you. Thank you to all our speakers, panellists, chairs. Thank you to our partners. Thank you to the events team at Lincoln’s Inn. Thank you for my team for keeping the magazine flying while I spun the plates of event logistics. But most of all thank you to you. I know you are ridiculously busy and I am genuinely grateful for you giving up your valuable time to attend our event.

Further reading:

Sustainable Investment Bootcamp: a resounding success

Financial returns from ethical investment funds ‘better than mainstream’ in last 12 months

10 signs that sustainable investment is going mainstream

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy10 months ago

Energy10 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change