Invest

Green Investment Bank could move to private ownership, says chair

The chairman of the UK Green Investment Bank (GIB) has said the government-owned bank should eventually be owned by the private sector.

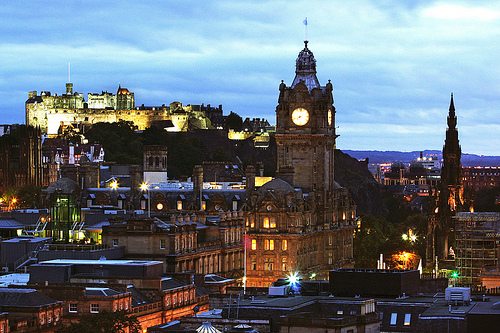

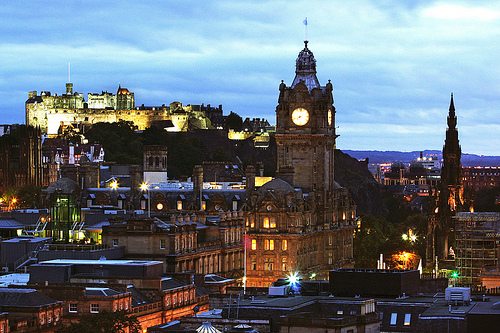

Speaking at the National Association of Pension Funds’ investment conference in Edinburgh last week, Lord Smith of Kelvin said he would like the GIB to ultimately diversify beyond equity investing into asset management and banking.

He said that although no such transactions are being considered, sovereign wealth funds had already approached the bank asking to buy equity.

He suggested that in 10 years’ time the board could ask the government to sell its stake in the bank.

“Let me dream a dream. I dream of the day when a majority of our equity is held by pension schemes like you – by sovereign wealth funds, too,” Smith said.

Launched in late 2012, the GIB is tasked with driving investment in low-carbon projects, with a focus on offshore wind developments, energy efficiency initiatives and the waste and bioenergy sectors.

The first bank of its kind, it operates with a double bottom line – it is as concerned with its green impact as its financial returns.

The bank is currently financed through equity worth £3.8 billion – to last until March 2016 – supplied by the government.

A report published last week by a committee of MPs urged the government to give more power to the GIB to borrow, in order to increase its investments.

The bank is currently restricted from borrowing by the Treasury until “government debt is falling as a percentage of GDP”. This was originally predicted to happen in 2015/16, though the committee expressed concern that the date would be pushed back after the autumn statement 2013 indicated a flat, rather than falling, trajectory.

MPs recently warned that the scale of green investment must be rapidly increased in order to tackle climate change and reduce the risks of a ‘carbon bubble’.

Committee chair Joan Walley MP said, “The UK government and Bank of England must not be complacent about the risks of carbon exposure in the world economy.

“The record-breaking extreme weather events causing chaos across the globe should be a wake-up call. The transition to a low-carbon economy will be much more painful if we wait until there is a climate crisis before recognising that more than half of the world’s fossil fuel reserves will have to remain in the ground.”

Further reading:

Green Investment Bank to support onshore wind sector

Green Investment Bank pledges £50m funding for energy efficiency

New York Green Bank officially kicks off

Green Investment Bank to invest in Birmingham renewables project

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future