Economy

New Report Finds Largest Global Miners Failing To Handle Major Climate Risks

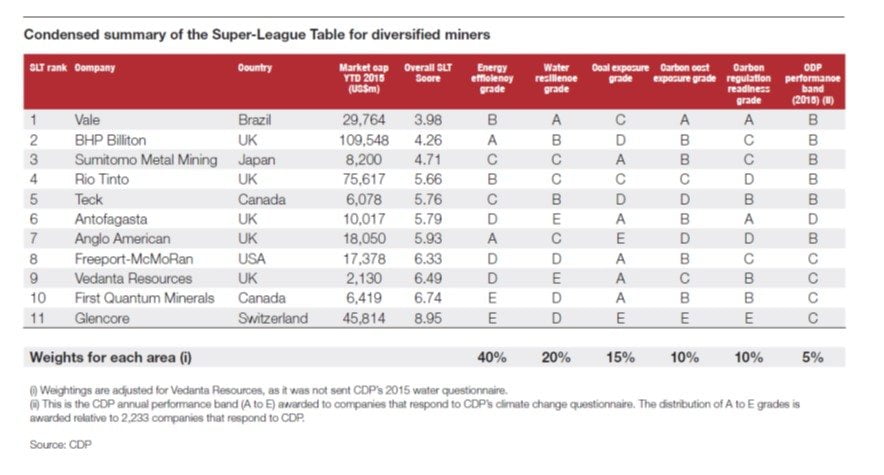

A new report, analyzing a group of the largest metal and mining companies, with combined market capitalization of US$329bn, has found they are failing to adequately manage carbon and water risks, with most unsupportive of new climate regulation.

The report uses data from CDP, the only global environmental disclosure system, and assesses whether the companies are taking action such as setting meaningful emissions reduction targets, conducting water stress evaluation or preparing for the expected tightening and expansion of carbon regulation set to emerge from COP21 in Paris.

Collectively, the 11 companies in the report account for around 85% of emissions among large, listed miners in one of the highest emitting sectors. The findings of the research include:

– No company achieved the top tier of grade (A or B) for all five criteria. All except two had a ‘D’ grade or below in at least one area;

– Only six of the eleven miners disclose meaningful GHG emission reduction targets;

– Glencore and First Quantum Minerals were the worst ‘across the board’ performers;

– Most (9 out of 11) large miners oppose new climate regulation. Only two appear to be ‘supportive of climate regulation’;

– US$10bn in earnings is at risk across the 11 ranked companies if a carbon price of US$50 per tonne is introduced as already accounted for by some companies;

– Almost 50% of company facilities are located in areas with medium or high water stress;

– Glencore is the clear laggard on carbon regulation readiness, due to its opposition to carbon pricing and dismissal of the concept of stranded assets;

– More than half the companies are involved in coal production, and together they represent 40% of the global seaborne (export) market in coking coal and 27% in thermal coal.

James Magness, CDP Head of Investor Research, said: “This research is a canary in the coal mine for investors. It shows that the world’s biggest mining companies, currently worth over US$329 billion, are unprepared for the transition to a low carbon economy. Although there are clear signs of progress by some companies in areas such as energy efficiency and water resilience, the sector as a whole needs to up its game. As a first step, all the large miners should be reporting meaningful GHG emission reduction targets and doing more to back new climate regulation.”

Paul Simpson, Chief Executive Officer of CDP added: “As the world prepares for a binding climate deal in Paris, this research highlights both risks and opportunities for extractive sector investors. It is the latest in CDP’s sector research series and is an ideal tool to help investors make smarter investment decisions and to engage their investees on these issues. As shown by the recent growth of initiatives such as the Montreal Pledge and the Portfolio Decarbonization Coalition, major investors now appreciate the impact of environmental factors on the bottom line, and they need reliable environmental data to accurately assess these financial risks and opportunities.”

Donald Macdonald, chair of the Institutional Investors Group on Climate Change added: “There is growing concern amongst investors about the long term sustainability of the mining sector so we warmly welcome this valuable research from CDP which used in connection with our guidance – Investor Expectations of Mining Companies: Digging deeper on carbon asset risk – will give investors excellent tools for progressive engagement with these companies.”

Disclosure to CDP is critical to achieving the highest level of data quality, as risk for non-responders cannot be assessed. The largest non-responders included Norilsk Nickel, Grupo Mexico and KGHM Polska Miedź. The research is available free for investors who are signatories to CDP.

Further to the tragic Samarco mining disaster in Brazil, the report also separately investigates potential industry exposure following new analysis of tailings dams across the sector.

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy10 months ago

Energy10 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change