News

Wonga to write off £220m of customers’ debts

Payday lender Wonga has elected to write off £220 million of customers’ debts, after discussions with the Financial Conduct Authority (FCA).

In response to a series of controversies, the company has put in place new affordability checks to screen their customers. After talks with City regulators, the firm has voluntarily ruled that the 330,000 customers who would not receive a loan under the new system will have their debts wiped out.

A further 45,000 people will now be able to pay back their loans without interest.

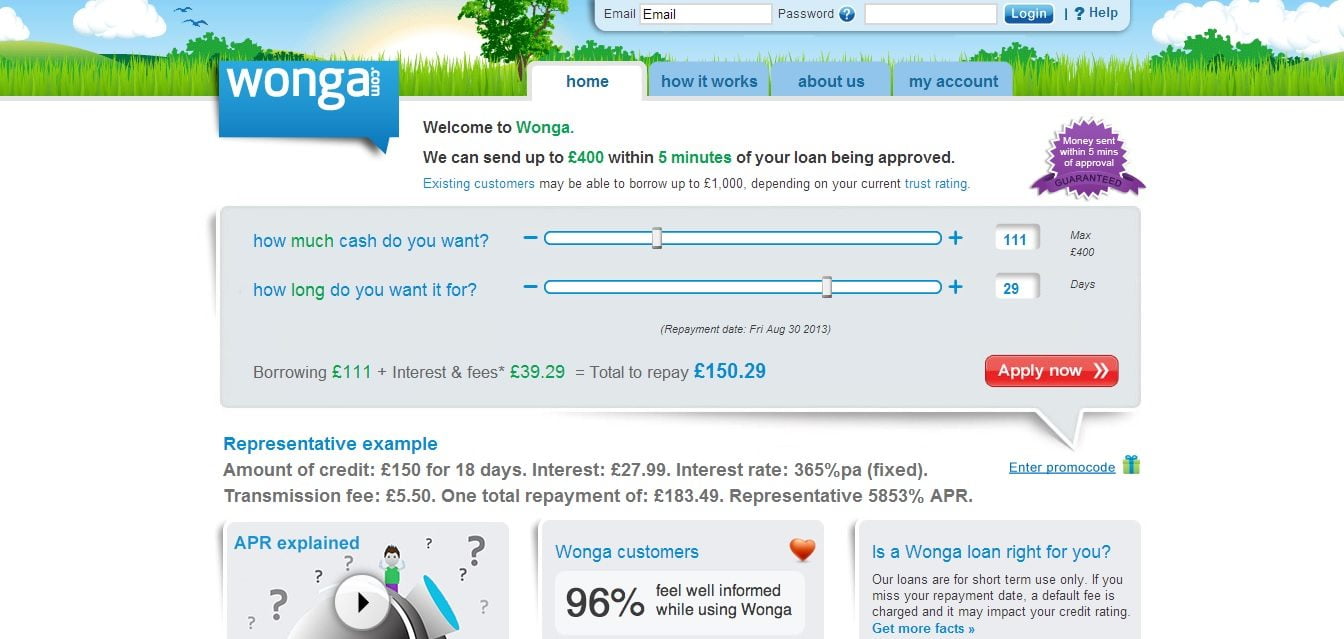

Wonga, like other payday lenders, has been heavily criticised for its high interest rates, which critics say are exploitative.

“We are taking action to address the failing of the past,” said Wonga chief executive Andy Haste

“This business had been too focused on growth and cared more about the loan outcome than the customer outcome. We are clearly very sorry for what’s happened to our customers and are doing everything to put that right.”

Clive Adamson, director of supervision at the FCA, added, “This should put the rest of the industry on notice. They need to lend affordably and responsibly.”

Earlier this week, Wonga revealed that its profits fell by more than half in 2013. The lender reported pre-tax profits for the year ending in December 2013 of £39.7 million. In 2012, the company raked in £84.5 million – a fall of 53%.

Largely responsible for this is the £18.8 million that Wonga was forced to pay in “remediation costs”, after it was revealed the firm sent fraudulent legal letters to customers.

The letters, sent between 2008 and 2010, threatened legal action over unpaid debts, but were sent by Wonga under the guise of fictitious law firms.

Recently released figures have also revealed that the number of complaints made against payday lenders has more than doubled over the past two years.

As a cheaper and more ethical alternative to payday lenders, many commentators have recommended that consumers turn to credit unions.

Further reading:

Wonga profits halved by compensation payouts

Savers should be allowed to access pensions and avoid payday loans, say experts

Wonga faces charges of £2.6m for impersonating law firms

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future