Economy

What we should really be doing about rising energy bills

We’re hearing a lot about rising energy bills and whether ‘green taxes’ are to blame. Sarah Butler-Sloss, Ashden founder director, doesn’t think so.

Let’s get real. As the BBC has pointed out, only 9% of today’s average household energy bill relates to so-called ‘green’ measures (and this includes some measures which are just for social, not environmental, benefit).

And green measures certainly aren’t the main reason for price rises: they account for just 15% of the price rise over the past six years, whereas increases in wholesale energy costs account for about 60%. It seems inevitable that wholesale costs will continue to rise, given our increasing dependence on imported fuel. And the fact that new nuclear generation is guaranteed almost twice the current wholesale cost of electricity suggests that politicians are fully aware that costs will increase.

Surely our politicians should focus on sorting out the really big issue: how to reduce the impact of increasing wholesale costs on homes and businesses?

How to cut bills

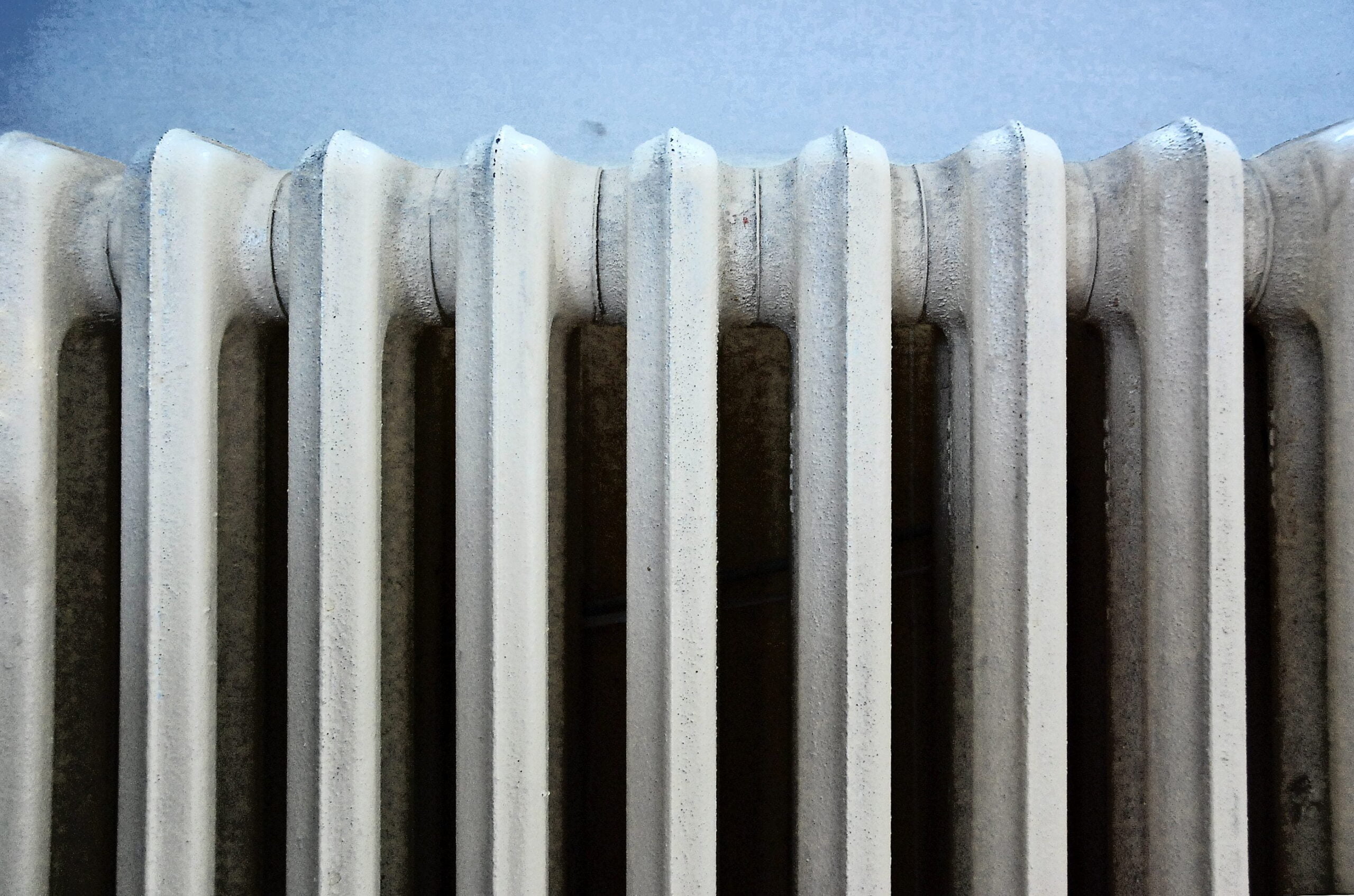

The most urgent action needed to cut bills, for now and in the long-term, is surely to reduce energy demand by investing in energy efficiency. Many measures bring large savings and quick returns on investment – for example, Energy Saving Trust figures show that the typical £300 to insulate the loft of a three-bedroom semi saves about £200* each year on gas bills; £475 to insulate cavity walls saves about £150* each year. Combined, these measures save more than three times the average ‘green tax’. And the savings start from the day that the insulation is installed.

Longer term, the priority must also be to reduce our dependence on the global markets that have been pushing up fuel costs.

For Ashden, this means serious investment in supplying more of our energy from renewable sources. Hydro, wind and solar schemes don’t suffer at all from fuel price rises because their ‘fuel’ is free, and their capital costs are falling. The more we supply from renewables, the more control we have over future costs, and the more secure our supply is.

For ‘green’ read ‘future-proofing’

And efficiency and renewable energy are, incidentally, what the green taxes support. The largest single component (about 42%) of ‘green’ tax goes to the Energy Company Obligation (ECO) scheme which insulates some of the UK’s lowest income homes – saving money on fuel bills for the people who really have to make the choice whether to heat or eat. The second largest component (33%) supports renewable electricity generation.

I think the green taxes might better be described as ‘future-proofing taxes’, because that’s what they are. Not such a snappy description, nor one that will trip easily off the tongues of politicians.

But it’s time to tackle the real problems. The wholesale cost of energy is the main component of our energy bills, it has gone up significantly and will continue to do so, and we can’t change that. What we can do is stop wasting energy by improving our energy efficiency, and supply more from secure renewable sources. And with serious investment in these areas now, we can achieve lower energy bills in future.

* Savings adjusted to take into account the fuel price rises announced recently.

Sarah Butler-Sloss is founder director of Ashden, a London-based charity that works in the field of sustainable energy and development and hosts the Ashden Awards annually. This article originally appeared on Ashden’s blog.

Further reading:

Cuts to green levy? Not on my watch, says Ed Davey

Rising energy bills prompt David Cameron to announce green tax review

Government to test cost of green energy policies amid rising bills