Editors Choice

New Thematic Portfolios Are Expanding The Viability Of Clean Energy

In 2018, renewable energy sources accounted for around 11% of the total energy consumption in the US and around 17% of electricity generation. This number has been growing steadily for the last 10 years, as we begin to understand that traditional energy resource depletion cannot be sustained at the current level. Renewable or clean energy are those which are naturally replenished, including from sunlight, wind, rain, tides, waves, and geothermal heat and those which give off zero emissions.

There is now an entire industry built around developing technology in order to harness clean energy more efficiently. As the renewable energy industry and the uses for it both grow, the companies that are at the forefront of building the technology have seen a general uptrend in their share prices.

TRADE.com, which is a multi-asset brokerage firm with offices across Europe, has made available Clean Energy thematic portfolios for trading. This allows investors the chance to gain exposure to the entire sector of Clean Energy, through thematics.

What Exactly Are Thematic Portfolios?

A thematic portfolio is a collection of stocks or assets which are grouped by theme, in this case Clean Energy. An investor will buy the portfolio, which is initially laid out as a default grouping. However, the investor can customize the portfolio, by adding or removing units of each security.

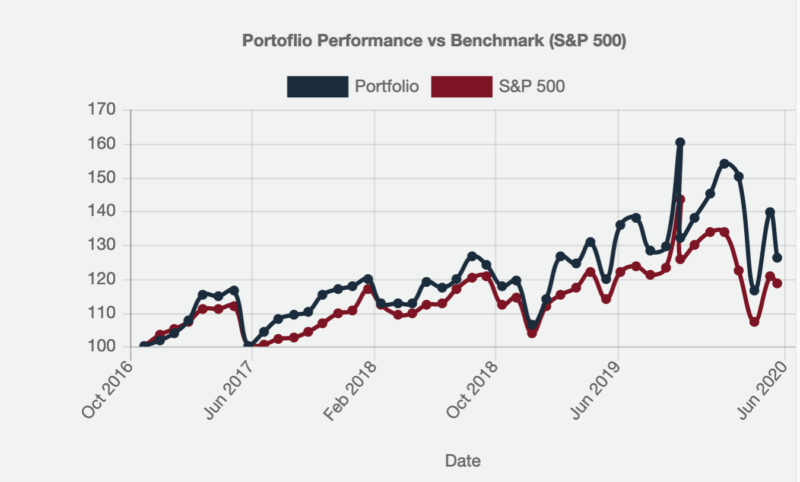

The chart below shows the performance of this portfolio, compared to the benchmark S&P.

Investing in Thematic Portfolios

Investing in this kind of product is popular for a number of reasons. Among these is the fact that, instead of relying on just one stock in a particular industry, you can gain exposure to a wide range of assets as a group to invest in through these portfolios. This opens you up to the wider industry that you are investing in as a whole, while also working to adequately diversify your investment and manage risk.

This kind of product is also ideal due to the fact that the portfolios you choose from are hand-picked by the experts from the brokerage firm. This stands them in good stead when it comes to performance, and they do in fact, measure up well against other broad scale investment instruments such as indices, and ETFs.

As an experienced trader, it is also an opportunity to invest in a specific sector where you may see a prevailing trend. This, and the fact that you can also edit the standard portfolios to include your own choices makes them a very flexible product.

Trading in Clean Energy

Among the variety of portfolios and sectors you can choose to invest in with thematic portfolios, that of clean energy is a popular choice. This may be due to the unpredictability of the oil industry, or the longer-term positive view when it comes to more sustainable energy sources.

This particular portfolio gives you the opportunity to have a piece of the major players across a range of niches in the renewable energy sector including solar, wind, and other companies involved in both the production and distribution of clean energies. A well-rounded selection of assets are available to make sure your investment is as balanced as possible through the TRADE.com thematic portfolios in clean energy in particular.

Final Thoughts

Thematic portfolios can leave you with a well-researched, highly diversified portfolio that you also may have your own input within if you wish. They can limit both your exposure to singular assets, and the amount of time you have to spend on researching individual stocks since the experts have already made selections to fill each portfolio. Overall, thematic portfolios from your standpoint as a trader are something of an all-in-one investment solution.

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future