Invest

Legal & General: ‘fundamentally wrong’ that CEOs are rewarded for share buybacks

Institutional investor Legal & General has criticised companies for rewarding chief executives for hitting earnings per share targets when share buybacks are involved. Instead the firm said it wanted companies to invest in the real economy.

Using excess capital to purchase the company’s own shares was described as “unfair” by the investor because it generates illusory value rather than real economic value. As a result, Legal & General doesn’t believe top staff should be rewarded when this process, or other similar financial engineering methods, has been used.

Speaking to The Times, Nigel Wilson, chief executive of Legal & General, said, “We don’t think chief executives should be remunerated for hitting an earnings per share target that’s been enhanced by buying back shares. There is this asymmetrical relation between doing nothing and getting big rewards for it, which just isn’t fair.

“We want to see capital invested in both intellectual property and physical infrastructure. Our message is that we will support good investment, just buying back shares will not make us happy.”

Remuneration packages at companies have recently come under fire, with some shareholders criticising the tie between short-term targets and rewards. They argue that this leads to businesses focusing on the immediate future rather than long-term and sustainable value creation.

Wilson added, “The share buyback does not generate real economic value, although of course it does generate personal financial wealth for anyone remunerated on a per-share metric.

“This seems fundamentally wrong, and as a big institutional shareholder – around 4% of everything in the FTSE – was are advising investee companies that our clear preferences is to invest in real growth and value.”

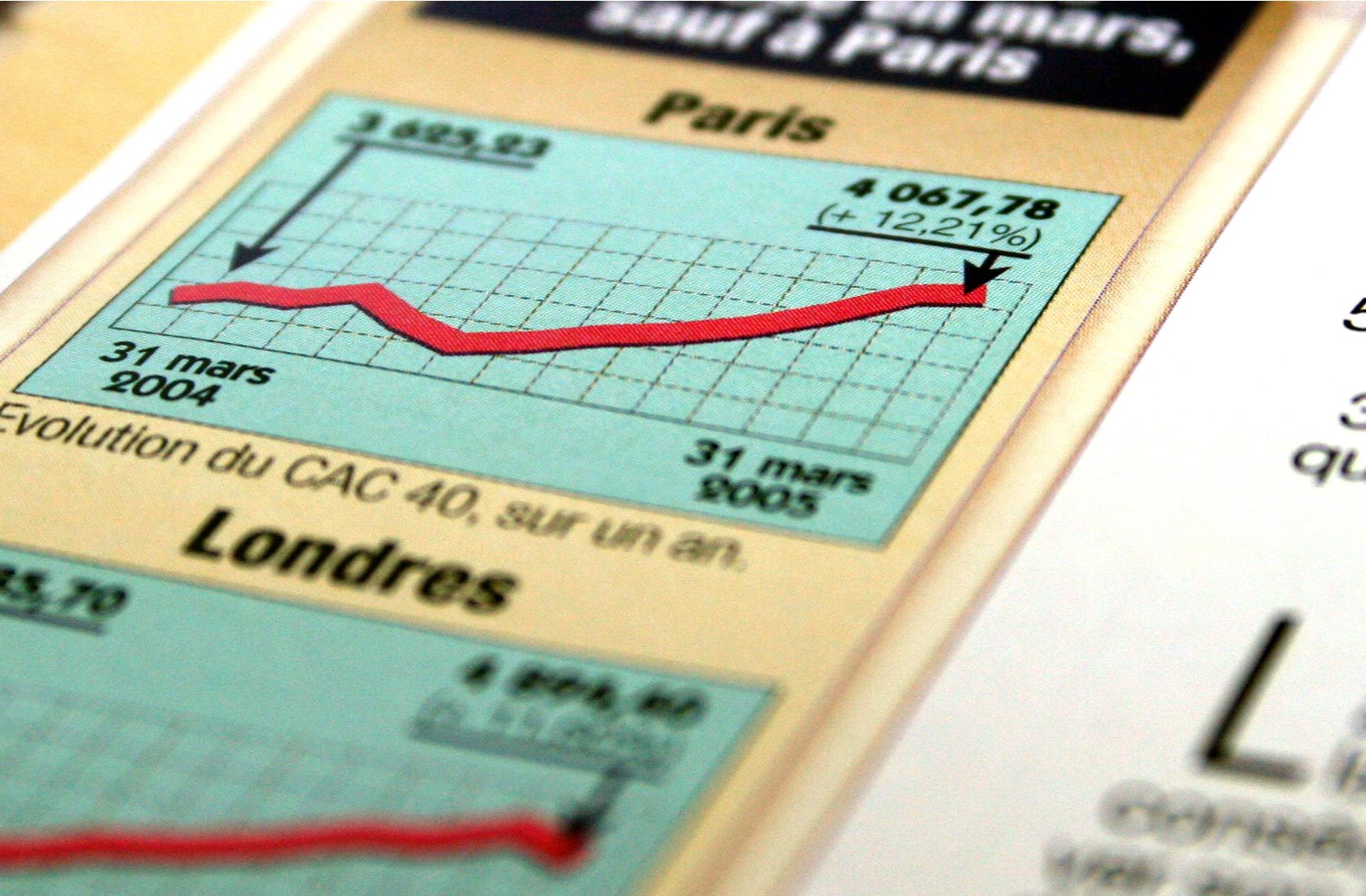

Photo: Gastonmag via Freeimages

Further reading:

Rising house prices fuelling inequality, says Legal & General

Legal & General back Social Enterprise Assist scheme in Croydon and Sussex

Vince Cable calls on FTSE 100 to create sustainable remuneration packages

FTSE 350 directors’ pay rises by 14%

Energy, pensions and banks: can we fix our broken markets for the long-term?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy11 months ago

Energy11 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change