Invest

Report: largest global banks failing to play long game on climate change

A new report examining 61 of the world’s largest banks on their management of climate-related risks concludes that despite welcomed statements and announcements by some banks ahead of COP21, few are taking a strategic approach to these potentially game changing developments. There remains a huge divide between banks’ current practices and the financial sector’s potential to support the transition to a low-carbon future.

The results showed:

Inadequate disclosure across the industry – Many of the banks surveyed do not adequately assess the carbon risk of their lending and underwriting, or conduct climate-related stress tests. No bank is currently measuring its carbon footprint.

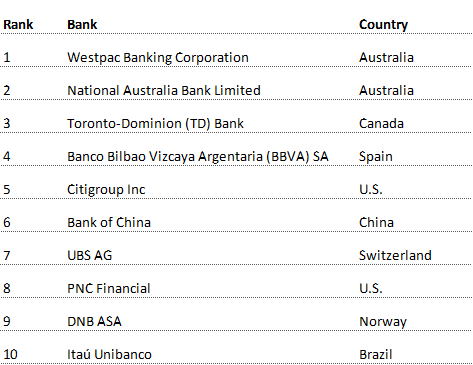

Some of the biggest banks are not at the table – Of the world’s ten largest banks only two are ranked in the Top 10 for climate management (Bank of China, Citigroup).

A $4.8 trillion opportunity not yet grasped – Significant funding is required for the transition to a low-carbon economy, yet most banks assessed do not have quantitative targets for increased investment/financing of energy efficiency or renewable energy projects.

The research was conducted by Boston Common Asset Management and backed by a $500bn coalition of 80 global, institutional investors. The banks included the world’s largest underwriters of carbon-intensive industries such as oil & gas, pipelines and coal. Lead investor partners included Australian Ethical Investment (Australia), Bâtirente (Canada), Church of Sweden (Sweden), Cometa Pension Funds (Italy) and Ethos Foundation (Switzerland).

Lauren Compere, Managing Director at Boston Common, said: “With the Paris climate summit fast approaching, the analysis shows a worrying lack of a strategic, long-term approach to climate risk across many of our leading banks. We believe banks are not adequately measuring, managing and disclosing these risks. COP21 highlights the significant need for investments to transition the world to a low carbon economy. Banks have a critical role to play here. As the Governor of the Bank of England said earlier this month there is still time to act, but the window of opportunity is finite and shrinking.”

Independent SRI Consultant John Fleetwood of 3D Investing said: “It’s astonishing that no bank currently measures its carbon footprint. Greater transparency on carbon exposure is welcome but there’s a long way to go and it strikes me as incongruous that many banks claim to be concerned about climate change but continue to lend to some of the most carbon intensive industries.”

According to the report the top 10 performing banks on climate management are:

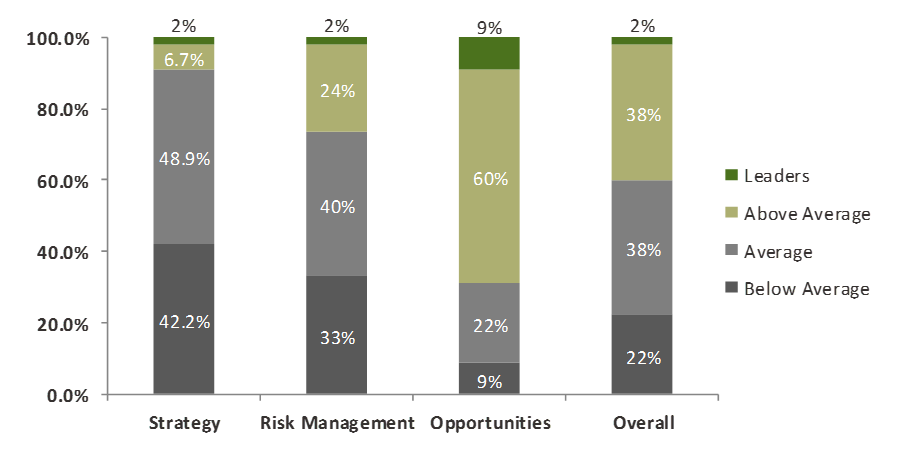

Overall bank performance:

Boston Common assessed the banks on a relative ‘peer-to-peer’ basis across three criteria: ‘risk management’, ‘climate change strategy’ and ‘opportunities’. In total 45 out of 61 approached banks responded with information in writing or as part of a dialogue.

Stuart Palmer, Head of Ethics at investor partner Australian Ethical Investment, said: “Leading banks are increasing the transparency of their lending to both fossil fuel and low carbon companies, along with measures to limit one and expand the other. While it is great to see Australian banks leading the way, clearer commitments are needed to align their businesses with a path to a safe climate future.”

“Boston Common’s Financing Climate Change Bank Initiative is an important addition to local activity in Australia, signalling to the banks the strong international interest in their governance of climate risk and opportunity.”

From strategy to stress tests the investor coalition agreed on four actions from the world’s largest banks to improve their rankings:

1) Establish long-term, comprehensive climate strategies with board-level oversight and links to compensation;

2)Report on total carbon footprint of their financing activities, with development of reduction targets.

3) Report quantitative figures for supporting energy efficiency and renewable energy; and

4) Conduct regular environmental stress tests.

The investor coalition is planning to follow up with the same group of banks to measure progress in the next year.

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy12 months ago

Energy12 months agoHow Renewable Energy Can Help Combat Climate Change, According to Indra Energy