Energy

UK’s First Energy Labels Confirming The Source Given To 500 Companies

500 Organisations will today be issued with the UK’s first Energy Labels by SmartestEnergy which include the source and carbon content of the clean electricity they buy.

This move is designed to boost the renewables industry and provide increased confidence to business consumers.

Construction products multinational Saint-Gobain UK, sustainable building company Willmott Dixon and education provider University of London are among the businesses which will receive labels tracing every megawatt they use to its source of origin, allowing them to report the exact carbon footprint of the power they use and their contribution to meeting UK climate targets.

SmartestEnergy Chief Executive Officer Robert Groves commented:

“For a while now, business customers have been calling for increased transparency around renewables to help them make the decision to switch that much easier. We now supply over 3TWh of renewable power – equivalent to the power needed to operate all of the streetlights in the UK for three quarters of a year[1][i] – all backed by origin certificates and evidenced by our Energy Labels, so the momentum for businesses to buy renewable is really growing. We call on other suppliers to provide the same level of clarity that we give our customers to help drive the renewables market and enable businesses to buy clean energy with confidence.”

SmartestEnergy is able to produce these Energy Labels because of the work it has done with the Carbon Trust. Every megawatt hour supplied is backed with an origin certificate, which is tracked and allocated in an Emissions Factor Model which has been certified by the Carbon Trust to be compliant with the Greenhouse Gas Protocol Product Standard.

Hugh Jones, Managing Director Advisory from the Carbon Trust commented:

We have been working with SmartestEnergy for the past two years and are very supportive of their continued efforts to provide clarity around 100% renewable electricity.

“Businesses have an important role to play in ensuring the UK meets its carbon reduction targets and it is initiatives like this that are helping to empower businesses to choose renewable power. The Energy Labels provide businesses with the rigour and traceability they require to navigate the complexities of renewable energy and carbon reporting.”

SmartestEnergy developed the Energy Labels in response to a call from the Aldersgate Group for clear labelling of the carbon content of electricity. A report[2][ii] from the sustainable business group, which represents companies with a turnover of over £400 billion, calculated that the measure could see low carbon electricity meet nearly half of all industrial and commercial demand by 2020, up from 14.4% to 48.3%.

Nick Molho, Executive Director, Aldersgate Group commented:

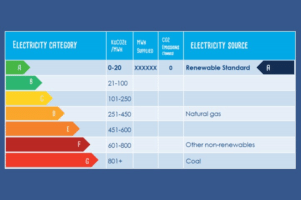

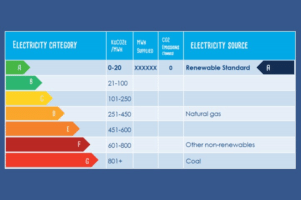

“The Aldersgate Group wrote the ‘Enable the Label’ report in 2014, proposing an electricity label to increase the transparency of energy bought by businesses in order to drive corporate demand for renewable electricity. It’s great to see one of the leading suppliers of renewable energy building on this work and bringing this much-needed tool to market. We hope this is the start of all UK suppliers providing an A-G rated label for the electricity they have supplied to their business customers, to help drive uptake of renewable electricity.”

The Energy Label initiative has been shortlisted for several industry awards including Guardian Sustainable Business and the BusinessGreen Leaders awards. This has also been shortlisted as the ‘Innovation of the Year’ at The Energy Awards in November 2016.

SmartestEnergy is Britain’s leading purchaser of electricity from renewables generators and buys directly from nearly 500 projects across the UK. It launched a suite of guaranteed 100% renewable products in October 2015 and is issuing the energy labels at the end of the first year.

Businesses can choose to buy: renewable energy from a blend of sources; natural renewable energy generated from sun, wind and water; or renewable energy from a particular source to meet specific requirements.

SmartestEnergy’s Business and the Renewables Revolution report, released earlier this year, revealed that switching to renewable power is the quickest and most cost-effective way for most organisations to cut their carbon footprint, it adds less than 1% to power bills, and it responds to growing demand from customers, investors and employees.