Features

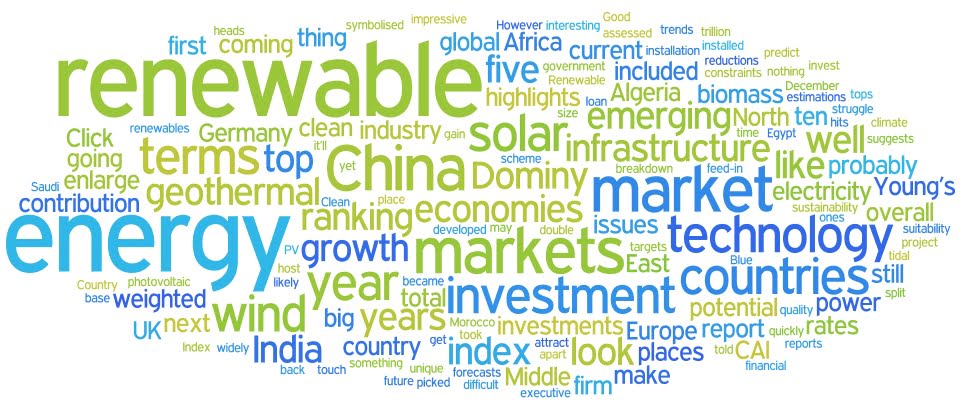

China tops renewable investment index

Ernst & Young’s Country Attractiveness Indices (CAI) report has deemed China to be the country most likely to attract renewable investors. 2012 is expected to be a mixed bag in terms of the fortunes of many global economies.

The professional services firm predict that the coming year will be a difficult one for more mature, established markets, because of financial constraints. However, impressive installation rates will see the economies of emerging market economies prosper.

Ernst & Young’s Country Attractiveness Indices (CAI) report has deemed China to be the country most likely to attract renewable investors. 2012 is expected to be a mixed bag in terms of the fortunes of many global economies.

The professional services firm predict that the coming year will be a difficult one for more mature, established markets, because of financial constraints. However, impressive installation rates will see the economies of emerging market economies prosper.

The CAI report ranks 40 countries in terms of their renewable energy markets and infrastructure, as well as their suitability for individual technologies.

China, followed by the US, Germany, India and the UK, make up the overall top five.

Click to enlarge.

Out of the four all-encompassing renewable energies – wind, solar, biomass/other and geothermal – China scoops first place for wind, the US tops solar and geothermal, and Germany holds biomass.

Phil Dominy, senior executive in sustainability and cleantech at Ernst & Young, told Blue & Green Tomorrow how it calculated the ranking.

“We look at what the current hotspots in terms of investments are, so we look at analyst reports and forecasts for the next five years, government targets, and we have our own estimations, too”, he said.

“In terms of total investment over the next five years, we expect these 40 countries to be the ones that are ahead.

“There may be other, more emerging markets, like in the Middle East or North Africa, but they’re starting from almost nothing, so there is very high growth but they’re still not huge yet.”

Ernst & Young assessed the renewable infrastructure and technology of each of the 40 countries. Infrastructure included electricity market regulatory risk, planning issues, grid connection issues and access to finance, whilst technology included power off take attractiveness, tax climate, grant/soft loan availability, market growth potential, current installed base, resource quality and project size.

Each parameter was weighted to determine an overall score out of 100. Then, to create the All Renewables Index, Ernst & Young took a 65% contribution from technology and 35% from infrastructure.

The technology share was split up into onshore wind, offshore wind, solar photovoltaic (PV), concentrated solar power (CSP), biomass, small scale hydro, geothermal and wave and tidal, again with each receiving a weighted percentage contribution to the total.

Speaking about the results of the index, Dominy said, “The big thing is that the developed market – places like Western Europe and the US – is going to struggle this year, and that’s symbolised by the recent German and UK reductions to the feed-in tariff rates.

“These sorts of markets are struggling to cut back on its budget, so it’ll be the emerging markets that will probably gain the highlights over the coming years, so places like Latin America, the Middle East, North Africa, Asia, India, China, and Eastern Europe to an extent as well.”

Looking towards the future, Dominy said that Ernst & Young’s research suggests there will be a wholesale shift in the ranking.

“If you look at the top ten, it’s still predominantly European”, he pointed out.

“Over time, the top ten, apart from probably China and India, will gradually slip down and others will move up the index from the middle or lower.”

Algeria, Egypt, Israel, Jordan, Saudi Arabia and Oman are picked out by the firm as countries with big potential for renewable energy growth.

Another – Morocco – is already well on its way, after it became the first country to announce it was to play host to the innovative Desertec scheme in December last year, with Algeria quickly following suit.

A breakdown of the index can be found in the infographic below.

Click to enlarge.

Ultimately, the Ernst & Young ranking highlights some interesting trends in the global renewable market. It’s widely reported that this year is going to be tough economically, so this is certainly not something that is unique to the renewables industry.

One thing is clear; the clean energy industry is spreading. To invest in renewable energy or make other more sustainable investments, get in touch with your IFA, or fill in our online form. If you want to support green energy at home, contact Good Energy, the UK’s only 100% renewable electricity provider.

Related artcles:

Clean energy investment hits trillion dollar mark

Environment11 months ago

Environment11 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features10 months ago

Features10 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features11 months ago

Features11 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy10 months ago

Energy10 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future