Economy

Experience ‘the power of your money’ with Triodos

At an event in Bristol in September, 500 people gathered to discuss banking – but not as we know it. Talk of executive remuneration was replaced by discussions about environmental responsibility, as customers of Triodos Bank learnt first-hand what their money was doing to benefit society, the planet and culture.

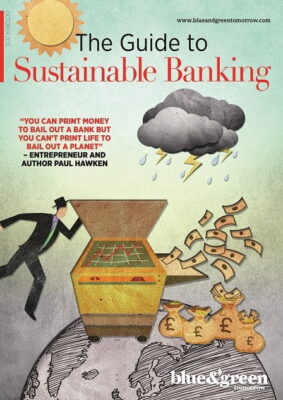

This article originally appeared in The Guide to Sustainable Banking 2013.

As one of the oldest dedicated sustainable banks in the UK market, Triodos has become a formidable name not only in the UK, but in continental Europe. The Triodos Group as a whole increased its customer base by 40,000 in the first six months of 2013, meaning now nearly half a million people bank with it across Europe.

Headquartered in the Netherlands with branches in Belgium, Germany, Spain and the UK, the group made international profits of £25.1m in 2012, and in the first half of 2013, racked up £15.6m. Meanwhile, the UK bank specifically broke the £500m barrier in its lending to sustainable businesses and projects in March this year.

“Fundamentally, if you want to experience the power of your money, then we can give you a way of doing that”, says the bank’s charismatic UK chief executive Charles Middleton.

“What you’ll get extra with us is that while your money is with us, it will really be making things happen which I hope people feel really good about.”

The bank currently offers a wide range of products, from standard savings accounts, through to cash ISAs, equity ISAs, retail equity funds and direct investment opportunities. The missing piece in its current wares though is a current account – one of the most expensive and complex products for a bank to offer.

For some time, one of the charges levelled at the alternative sector is that there are simply too few day-to-day banking options available. However, at the event in Bristol – an annual general meeting for customers to connect with the projects they help finance – Middleton confirmed a rumour that had surfaced a few months before: Triodos has plans in place to launch a current account.

“When we made the announcement, there were resounding cheers from the floor which is always encouraging”, Middleton laughs.

“To be honest, though, we would expect that from that group of people. They are people who are very obviously supporting us in a very positive way. But there is broader evidence of that appetite, and I think it’s a natural progression for us.

“We feel confident that in any way people want to engage in the social or environmental sectors, they can do that through us. So it makes sense to launch a current account so that people can actually bank with us as well.”

Middleton, 56, spent 21 years at Barclays before joining Triodos in 2003. Not your average bank chief executive, he told Blue & Green Tomorrow in the 2012 edition of The Guide to Sustainable Banking that the bank’s mission and values were “absolutely aligned” with what he wanted to do after two decades in the mainstream banking arena.

Twelve months down the line since our last in-depth conversation, his former employers have turned somewhat of a corner, with new boss Antony Jenkins urging the bank’s 140,000 employees to quit if they didn’t sign up to its renewed ethical values.

“One should applaud that, and at the same time, challenge them to push that through so it really becomes real”, Middleton says of Barclays.

“There have been some indications of these banks trying to take their businesses forward in a direction that has more responsibility, that takes the whole issue of their presence in society more seriously, but let’s be honest, I think the jury is still very much out in terms of whether that’s really going to have the impact we want it to have.

“I would support any initiative that is going to help move these banks in the right direction, but I think it’s very early days in terms of how they really are. I’m an optimist; I think the banks have hit a seriously low point and it is shameful that the financial sector has got into this position.

“My sense is that we can’t get any lower, but we’ve been proved wrong on that before. What is really encouraging, though, is that there are definite signs of people making more conscious choices. That will not only help us, but it will also influence the banks to change.”

Triodos remains a kingpin of sustainable banking in the UK. Its current account is set to be launched at the back end of 2015 or in early 2016, and the bank has also recently unveiled a pair of ethical investment funds in an effort to widen its impact.

But why do people bank with Triodos? What are their motivations? One customer at its AGM recently told Blue & Green Tomorrow, “I feel it’s important that financial organisations have a beneficial impact on society rather than a detrimental one.” A simple explanation, and one that suggests banking – contrary to popular belief – does not have to be evil after all.

Further reading:

Triodos Bank AGM: profits or philanthropy is a false choice

Small is beautiful: why alternative banks need to step up to the mark

Swimming against the tide: ethical banks as countermovement

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy11 months ago

Energy11 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change