Economy

British banks use less than half of their assets to fund the real economy

Most commentators seem to agree that a return to ‘back to basics’ banking is needed if we are to avoid the kind of speculative bubbles that tanked the global economy in 2008.

This means banks should focus on taking deposits and offering loans, and making a fair margin on the difference in interest rates between the two. (Once, bankers were said to adhere to something called the 3-6-3 rule: pay 3% interest on deposits, loan at 6%, and be on the golf course by 3pm. This was characteristic of a lazy, uncompetitive banking market, but one which, at least, didn’t crash the world economy.)

How close are we to achieving this ‘back to basics’ banking model in the UK? Greg Van Elsen of the Belgian NGO FairFin last year published a report, A Bank in Reverse, which investigated this question in a Belgian context. The report looked into the financial statements of banks active in Belgium, and sought to identify the country’s “most respectable” bank, that which was most dedicated to funding the real economy and least concerned with short-term trading for profit.

“We are convinced”, wrote FairFin, “that most banks should become somewhat better behaved, and be mostly at the service of the real economy. So in fact, a bank in reverse.” So let’s look at the equivalent data for the main banks in the UK.

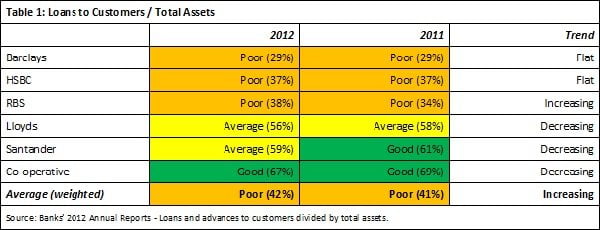

One of the important ratios the report looked at was the proportion of a bank’s assets which is accounted for by ‘loans and advances to customers’, including lending to businesses and individuals (but not to other banks). This is, after all, what we expect banks to be doing with our money.

Looking at this data for the UK’s main banking groups shows that overall, banks are only using a minority of their assets to provide loans to their customers. In fact, just 42% of the total assets held by British banks is actually loaned to customers. While some of the rest is held as cash and in central banks, a much larger amount is held in derivatives and other short-term assets ‘held for trade’.

Barclays stands out as the only bank with less than one-third of its assets being lent to customers. HSBC and RBS also use a minority of their capital for what most of us recognise as ‘banking’. While none of the British banks fared as badly as Deutsche Bank, which FairFin found used only 19% of its assets for lending, this is a poor picture overall. The Co-operative Bank was the only bank lending out more than two-thirds of its balance sheet to customers.

This is a simple ratio to calculate, but it tells us something about how much of a bank’s attention is focused on financing the real economy.*

This is a simple ratio to calculate, but it tells us something about how much of a bank’s attention is focused on financing the real economy.*

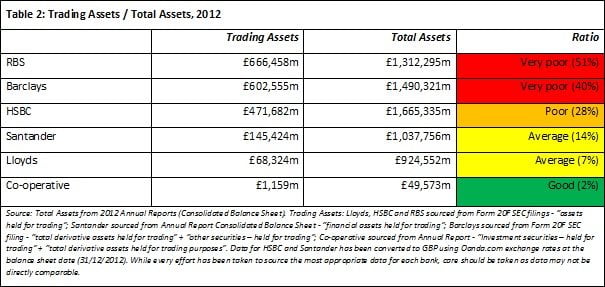

Calculating the amount of money banks set aside for short-term trading is a more challenging task, and directly comparable figures are not available for all banks. (As such, this data should be treated with caution.) Again, following FairFin’s methodology, the data below looks at the securities portfolio of the banks to identify ‘securities held for trading’ – the assets most likely to be held for short-term profit-making. (‘Securities held to maturity’, in contrast, concern assets that a bank intends to hold to maturity, and thus are not speculative in nature.)

These figures show a clear correlation between those banks lending a smaller proportion of their capital to customers and those with investing a greater proportion in speculative trading. The Royal Bank of Scotland (RBS) and Barclays stand out as the two banks dedicating more of their assets to short-term trading than they do to actual loans to customers. For RBS – 82% owned, of course, by the British taxpayer – more than half of its assets are ‘held for trading’. The Co-operative Bank, meanwhile, reports investment in derivatives at just 2% of its total assets.

This is analysis is certainly a simplification of the complex operations of today’s banking giants, and further research is needed to identify trading assets which may support the real economy in a positive way. Also, it must be noted that few banks disclose enough information to identify how much of their loans to customers are supporting unsuitable or unjust economic activities.

This is analysis is certainly a simplification of the complex operations of today’s banking giants, and further research is needed to identify trading assets which may support the real economy in a positive way. Also, it must be noted that few banks disclose enough information to identify how much of their loans to customers are supporting unsuitable or unjust economic activities.

However, the aim of this analysis is to identify what proportion of a bank’s attention is focused on the productive economy, and what proportion is being gambled in pursuit of short-term profits. The data suggests that, for most of the sector, ‘back to basics banking’ remains a long way off.

* While this analysis is new, similar data has been produced by others in previous years. After compiling these figures, it came to my attention that a similar exercise was carried out on the basis of 2011 data by the European Green party for the website bankingsins.eu. This data is consistent with their figures, but provides an update for 2012, as well as some additional analysis on the picture for the overall market. Their methodology for calculating speculative activity was slightly different, focusing purely on derivatives.

Ryan Brightwell is the founder of Bright Analysis, a research consultancy for sustainability and social change. He was formerly ethical projects adviser at The Co-operative Group.

Further reading:

Banking regulator fines RBS £5.6m for inaccurate transaction reporting

Big five’s banking monopoly at risk, with 2.4m closing accounts in 2012

Small is beautiful: why alternative banks need to step up to the mark