Economy

It’s time to believe in banking again

Sean Buchan is actively switching his banking choices. Whilst doing this, he reflects on why such a simple action faces so much resistance and inertia across the general public. He concludes that in the end, it is mostly due to ourselves.

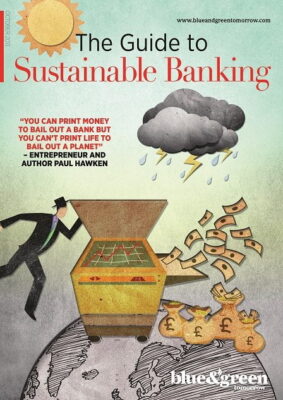

When you hear the word ‘banking’ what is the first thing you think of? A vault where you store your money? Sky high yet undeserved bonuses to top executives? How about… an opportunity to do a good thing with relatively little effort?

Experience tells us that almost nobody thinks the latter, at least not immediately. That’s a shame, seeing as where you store your money might be the most powerful decision you can make.

The situation might have been grim before 2008, but ever since that, implicit distrust was transformed into an explicit shunning of all things money-related. Economics has drifted further into the realm of pseudo-science that nobody understands. Meanwhile, bankers and all those associated are not to be trusted.

It’s easy to see why people would think that. Even the IMF said 2008 was the biggest financial crash since Wall Street, and recently, unemployment levels in the UK hit their highest levels in nearly two decades. At the same time it appeared that those that were largely responsible, with the exception of a few high profile names, got away unscathed.

But that’s not the whole story of banking. The upcoming National Ethical Investment Week urges us all to cast our eyes away from headline grabbers – for unfortunately bad news still forms the majority – and consider an ever-growing fringe of banking in the hope that it will not be considered fringe any longer. This is the phenomenon of banking sustainably.

The delights of modern technology allows a plethora of information on ethical and sustainable banking options to arrive at our fingertips with very little research. Thanks to increasingly easy-to-use platforms such as Ethex and the Social Stock Exchange, as well as in-depth tools such as the Move Your Money scorecard, one can go from belligerent naysayer to having even a little shred of hope in under an hour.

Next, a few hours of more of detailed research, or perhaps consultation from an adviser, and finally, make the switch completely online or over the phone. It’s possible to have one’s banking life transformed with relatively little effort. That’s current account, savings and investment funds alike, with all that money doing good.

So what causes us to be so sceptical and inert in the first place? Well, it is true that mainstream information out there has been lacking. I personally went through an entire undergraduate degree in economics, including a placement in industry, without hearing the phrases ‘sustainable banking’ or ‘ethical banking’ even once.

Seeing as that’s a money-heavy profession it is a little hard to imagine the prominence of these concepts elsewhere. In recent times it seems, just as with I, one needs to search for it. This needs to change.

Fortunately press such as Blue & Green Tomorrow and bodies such as the UK Sustainable Investment and Finance Association (UKSIF), which is running National Ethical Investment Week, seek to make that change.

However, aside from a lack of mainstream prominence, our scepticism and inertia is mostly due to ourselves. Consider the self-fulfilling prophecy. If a gentleman approaches us in the high street and offers us an ethical banking option, our immediate thought is to probably think of him as a phony.

Firstly he is selling something, which involves making money; the very thing that is evil. Secondly he’s selling banking, which involves money; the very thing that is evil. This cannot be ethical or sustainable in any way.

In reality we haven’t given the man a chance. We haven’t considered that there is an opportunity to do good with our money. Realistically, every moment is an opportunity to do something good.

Guns don’t kill people; people do. Television isn’t trash; it depends what channel you watch. Money is not evil; it is what you do with it. There is no need to distrust something or somebody just because of a general association.

Anybody still reading this article is likely already converted or close to it. Thus this is more a call to everybody to realise how much this current status quo affects the position of sustainable banking today and actively challenge it whenever we hear or see it. In the end, it is we, and only we – the discerning members of the general public – that decide whether something is fringe or whether something is mainstream.

Wouldn’t it be great to see sustainable banking as the standard option? Don’t you think it’s time to believe in banking again?

Sean Buchan is a freelance writer specialising in the areas of economics, philosophy, principles and ethics. A principled person himself, he is the founder of www.TrueEfficiency.net and makes a point of only investing his time into projects he truly believes in. You can also follow him at @TrueEfficiency and www.facebook.com/TrueEfficiency.

Further reading:

An analyst’s view on changing banking culture from within

One responsible banking system to rule them all

Big five’s banking monopoly at risk, with 2.4m closing accounts in 2012

Small is beautiful: why alternative banks need to step up to the mark

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future