Economy

Major changes needed to redirect investment onto a long-term path

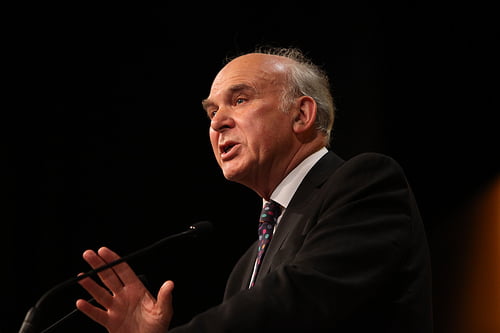

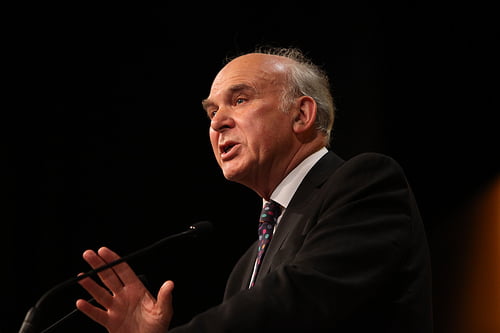

The business secretary Vince Cable has today called for a “fundamental change” to the way the investment industry works, in response to Professor John Kay’s independent review of UK equity markets.

The Kay Review, which was published in July, urges the market to opt for long-term instead of short-term growth, and Cable claimed that it will help “restore trust” in the system.

“Many of us feel that in the past, our public companies and investors have focused on short-term profit at the expense of long-term value”, he said.

“The behaviour of many banks in the run up to the financial crisis is an extreme example of this quick buck mentality, but there is clearly a wider problem.

“That’s why I asked John Kay to look at what could be done to ensure equity markets support good, long-term decision making. His insightful review calls for a shift in the culture of investment and sets a clear challenge to companies and those who invest in them.”

Recommendations in the Kay Review include the abandonment of mandatory quarterly reporting, so that companies shy away from focusing solely on the short-term. It also calls for the establishment of an Investors’ Forum, which it says will “champion constructive engagement with companies”.

In total, Kay sets out 17 recommendations that he feels the government can realistically deliver, and Cable added that he is optimistic about its chances of doing so.

“[Kay’s] agenda is an ambitious one but I am very encouraged by the level of engagement we have seen already from investors”, Cable said.

“Not only on Kay’s ideas, but through our directors’ pay and shareholder voting reforms; in addressing diversity on corporate boards and through changes to the way companies report their business strategy and results.

“These actions will help restore trust in markets and in the system of capitalism on which our future prosperity depends.”

Cable’s encouraging words about the future of the investment industry have been welcomed by the UK Sustainable Investment and Finance Association (UKSIF).

“Today’s statement shows that the Kay Review could become as influential over time as the 1992 Cadbury report on corporate governance which celebrated its 20th anniversary this year”, said Penny Shepherd, UKSIF chief executive.

“It is particularly positive that today’s speech builds on the Financial Services Authority’s (FSA) recent call for asset managers to review their approach to conflicts of interest.

“We hope that the FSA, the Pensions Regulator and other regulators across the investment chain will focus on the dysfunctional cultures and practices that Professor Kay has highlighted.

“Investors also need a wider public policy framework that encourages sustainable and responsible corporate behaviour. For this reason, we hope that the forthcoming energy bill will also demonstrate this commitment to the long-term.”

Christine Berry, head of policy and research at FairPensions, also welcomed Cable’s comments.

“We’re very pleased to see the government taking forward Kay’s recommendation on clarification of investors’ duties“, she said.

“For too long, narrow interpretations of the law have acted as a roadblock to long-term and sustainable investment strategies. We look forward to working with [the Department for Business, Innovation and Skills] and the Law Commission to resolve this issue in a timely and effective manner.”

A FairPensions report recently highlighted that despite a government consultation on excessive executive pay, 72% of institutional investors opposed plans for a binding vote. This comes after the group ran a training event to encourage employees and shareholders to campaign for responsible investment within their pension funds.

Further reading:

What kind of investor are you?

The long-term matters, and sustainable investment holds the key to prosperity

Sustainable investment flourishes amongst European high net-worth individuals