Economy

Sustainable Investment Bootcamp, Leeds – review

Blue & Green Tomorrow hosted a Sustainable Investment Bootcamp for financial advisers on April 24 in Leeds.

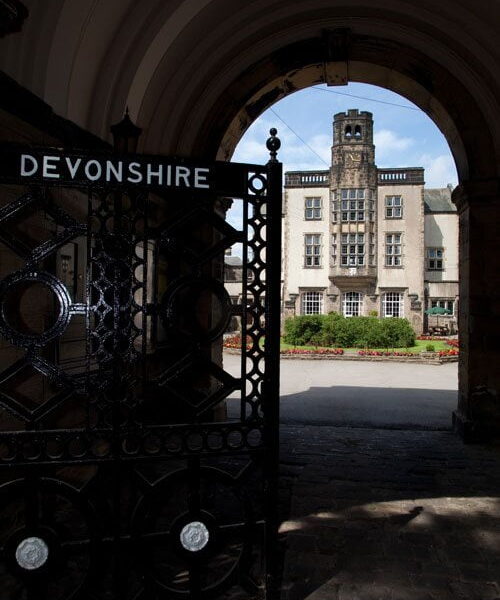

The event was tailored for those who have an interest in sustainable investment, but do not feel they have sufficient insight to advise clients on the subject. Four leading funds presented on some of the key themes that sustainable investors are thinking about – to a packed room of advisers at Devonshire Hall.

Blue & Green Tomorrow founder and publisher Simon Leadbetter kicked off the event by talking about some of the social and environmental trends we face. He made the point that the future could be really grim – with overconsumption, biodiversity loss, water and resource scarcity, ocean acidification, pollution and climate change just some of the threats – but added that investors were seeking to tackle such issues by investing in real solutions.

Delegates were then shown a TED talk by sustainable investment expert Chris McKnett, in which he makes a compelling case for investment that considers non-financial factors as well as financial ones. He concludes in the talk, “By investing sustainably we’re doing two things. We’re creating insurance, reducing the risk to our planet and to our economy, and at the same time, in the short-term, we’re not sacrificing performance.”

Clare Brook, founding partner of the listed equities team at WHEB, was the first of four speakers. Brook spoke about her career in sustainable investment – which spans almost 25 years – and WHEB’s award-winning Sustainability fund. She explained how the fund looks to invest in solutions to sustainability challenges, adding that most mainstream analysts will generally only focus narrowly on a company’s financial metrics – rather than gain wider insights by thinking about social or environmental factors.

Clare Brook, founding partner of the listed equities team at WHEB, was the first of four speakers. Brook spoke about her career in sustainable investment – which spans almost 25 years – and WHEB’s award-winning Sustainability fund. She explained how the fund looks to invest in solutions to sustainability challenges, adding that most mainstream analysts will generally only focus narrowly on a company’s financial metrics – rather than gain wider insights by thinking about social or environmental factors.

She was followed by Peter Michaelis, head of sustainable and responsible investment at Alliance Trust Investments whose talk was entitled “Obvious with hindsight: investment challenges for the next decade”. He said companies that support society are more likely to be supported by society – whereas companies that don’t are less likely to be supported. It is for this reason that Alliance Trust invests purely in what it considers to be sustainable companies.

The first speaker after the lunch break was Claudia Quiroz from Quilter Cheviot, who explained how to turn some of the environmental trends – climate change, resource scarcity and so on – into investment themes. She told delegates about the Quilter Cheviot Climate Assets fund that she runs and urged them to acknowledge that sustainable, responsible and ethical investment meant different things to different investors, but from an investment viewpoint means investing in markets that make high economic sense, like energy efficiency.

The first speaker after the lunch break was Claudia Quiroz from Quilter Cheviot, who explained how to turn some of the environmental trends – climate change, resource scarcity and so on – into investment themes. She told delegates about the Quilter Cheviot Climate Assets fund that she runs and urged them to acknowledge that sustainable, responsible and ethical investment meant different things to different investors, but from an investment viewpoint means investing in markets that make high economic sense, like energy efficiency.

Neville White from Ecclesiastical Investment Management was the fourth and final presenter. His talk, called “Accentuate the positive(s)”, took the audience through Ecclesiastical’s process of investing in a company. He used the example of a gold bullion exchange-traded fund (ETF), and explained how the firm undertook extensive research, including taking a lead role engaging with the World Gold Council, before deciding whether it was ethical to invest in it.

The advisers in the room were then shown data from Blue & Green Tomorrow’s Voice of the Adviser survey. Published in January, the report surveyed around 400 financial advisers about a range of issues – ranging from their opinions on sustainable investment and the economy to Scottish independence and whether the UK should remain in the EU.

Following this, the session was split up into two workstreams, with two funds in each session. Delegates were invited to quiz the investment houses as well as share their own thoughts on sustainable, responsible and ethical investment.

Following this, the session was split up into two workstreams, with two funds in each session. Delegates were invited to quiz the investment houses as well as share their own thoughts on sustainable, responsible and ethical investment.

The Leeds event – the first of six bootcamps taking place around the country in 2014 – followed on from the September 2013 conference in London in being a resounding success.

On May 22, we will be in Liverpool for the second bootcamp. For more details on attending one of the five future events, see here.

Further reading:

The Guide to Sustainable Investment 2014

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future