Economy

Sustainable Investment Bootcamp, Edinburgh – review

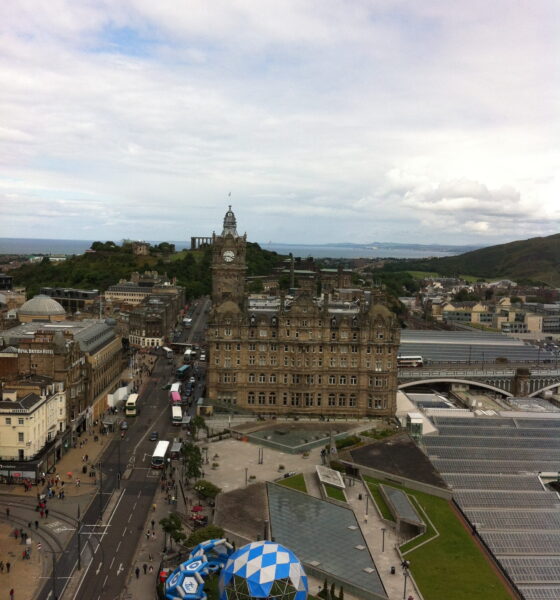

Blue & Green Tomorrow hosted a Sustainable Investment Bootcamp for financial advisers on June 26 in Edinburgh.

Four leading funds presented and discussed a range of sustainable and responsible investment themes to a number of interested advisers, which was hosted by Standard Life in its central Edinburgh office.

The bootcamp was the third of six taking place around the UK in 2014, and it followed on from previous events in London, Leeds and Liverpool.

Opening the event, Blue & Green Tomorrow founder and publisher Simon Leadbetter spoke in great length about some of the environmental and social trends the world faces. He added how sustainable investment can rebalance and address people and planet and lead to sustainable wealth and prosperity for all.

Clare Brook, founding partner of the listed equities team at WHEB, was the first of the funds to speak. She delved into some of the failings of the fund management industry – its short-termism, its lack of transparency and its focus on benchmarks which are backward-looking and may miss the bigger picture. She said how a sustainable investment strategy can add value to the investment process, by investing in solutions to major challenges facing the human race. She emphasised that the team at WHEB sets great store by being long-term and transparent, in contrast to much of the mainstream fund management industry.

Neville White, head of socially responsible investing at Ecclesiastical Investment Management, was up second to speak. He gave a comprehensive overview of the firm’s important positive investment pillars, and explained how to apply positive criteria to an investment portfolio. The case study he used was whether it is ethical to invest in gold bullion. To answer this question, Ecclesiastical engaged with the World Gold Council which resulted in it being actively involved with the industry body in pioneering a new globally accredited standard for conflict-free gold.

Following on from this, Peter Michaelis, head of sustainable and responsible investment at Alliance Trust Investments, identified a variety of prominent sustainability challenges – including climate change and corruption. He said today’s dynamic and rapidly adapting society and economy favour those companies driving sustainability and will ultimately benefit them in the long-term.

The fourth and final fund to present was Quilter Cheviot’s Climate Assets fund. Investment director William Buckhurst detailed how the merging of large-scale drivers like climate change, population growth and resource scarcity will bring about investment opportunities in a new economy. In the new economy, investing in themes like energy efficiency can be very rewarding, he explained.

Finally, before the lunch break, there was a Q&A session with two specialist ethical financial advisers, Julian Parrott (Ethical Futures) and Scott Murray (Virtuo Wealth). The pair took questions from the floor on performance, engagement and some of the possible barriers that are hindering the ethical and sustainable investment sector’s growth.

After the break, advisers in the room were shown data from Blue & Green Tomorrow’s latest Voice of the Adviser survey. The report surveyed around 400 financial advisers about a range of issues, from their opinions on sustainable investment and the economy to the timely debate of Scottish independence.

The bootcamp was then split up into two workstream groups with two funds in each session. Delegates were invited to quiz the investment houses as well as share their own thoughts on sustainable, responsible and ethical investment.

Lesley Duncan, investment director at the bootcamp’s host Standard Life, wrapped up the day with a presentation highlighting recent trends in ethical investment and the power of the shareholder in improving corporate governance.

Later on this year during Sustainable September (September 16), we will be in London for the fourth sustainable investment bootcamp. For more details on attending one of the future events, see here.

Photo: Seth Kirby

Further reading:

Further reading:

Sustainable Investment Bootcamp, Liverpool – review

Sustainable Investment Bootcamp, Leeds – review

Sustainable Investment Bootcamp: a resounding success

Video: Sustainable Investment Bootcamp

Financial advisers sought for sustainable investment bootcamps

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future