Economy

Index Investing and Its Implications For Reducing Carbon Risk

Index investing strategies – also referred to as passive investing – are rapidly growing as a proportion of the market. In 2016, passive equity vehicles accounted for over 40% of total US equity fund assets, up from 18.8% a decade ago, according to Morningstar. This is representative of the global trend, with over $4 trillion in savings now in index funds.

The reason for this shift in assets is clear. Investors are disillusioned with active investing strategies that charge higher fees and typically fail to perform better than more cost-effective index-based counterparts.

In a low-return environment where fees and performance come under particularly harsh scrutiny, it is hard to see an end to this accelerating shift towards passive investing, particularly as technology continues to drive down costs. This has important ramifications for how financial flows can be guided to address the financial risks and opportunities linked to climate change.

Firstly, stock market indexes, acting as benchmarks for fund performance or as the basis of investment strategies, will occupy an increasingly important role in the allocation of capital across the economy. However, pure index investing strategies reward companies solely on the basis of current financial performance and fail to anticipate future risks and opportunities such as those created by the low-carbon transition.

Secondly, the role of investor engagement on climate change with investee companies will become an increasingly important function for index houses and passive investment funds. Blackrock, Vanguard and other asset management giants have been openly criticised for their failure to use their position of significant influence to vote on shareholder resolutions relating to climate change.

A new type of index – the Engaged Tracking index

Engaged Tracking Indexes embed the principle of investor engagement directly into the index investment strategy. They include non-financial criteria, such as sustainability indicators, when weighting companies within the index. The index provider contacts index constituents to inform them of the non-financial criteria on which they will be ranked and what steps are required to improve their position.

Simply put, companies have to do better on non-financial performance to move up the rankings and to attract more investor capital.

This provides an innovative and cost-effective form of index investing which incorporates stewardship principles and shareholder engagement. Engaged Tracking Indexes clearly communicate investor expectations to constituent companies. They are a systematic tool for reallocating capital according to non-financial performance in a transparent manner.

Engaged Tracking (ET) Low Carbon Indexes go beyond reweighting companies according to the intensity of their direct carbon emissions and take into account the full scope of their carbon footprint. Reweighting within the index is done according to a company’s ET Carbon Rank, which includes Scope 1, 2 and 3 emissions. The ET Low Carbon Index methodology incentivises ever increasing disclosure and lowering of emissions since these are the criteria upon which the Rankings are based.

ET Low Carbon Indexes enable investors to position themselves in a forward looking way to reduce their exposure to systemic carbon risk, while simultaneously signalling to investee companies that investors expect a swift transition to more carbon-efficient business models. They provide a systematic tool for redistributing capital from high to low-carbon companies in the most efficient manner possible.

In the case of the ET Carbon Rankings and corresponding ET Low Carbon and Fossil Free Index Series, constituent companies are informed of the following Engaged Tracking Investor expectations:

- Measure and disclose a full Scope 1, 2 and 3 greenhouse gas emissions inventory.

- Disclose in annual reports how action to limit global warming as part of the Paris Agreement may affect operations.

- Publish business transition plans that explain how the company will manage the business risks and opportunities arising from a 2 °C regulatory environment, including those related to GHG emissions, capital expenditure, remuneration policy, and political spending, among other enterprise risks.

- Communicate how such a business transition plan can be implemented.

Decarbonising portfolios without sacrificing performance

ET Index Research offers a suite of indexes which track major market indexes like the S&P 500 allowing investors to significantly reduce their exposure to carbon risk without sacrificing performance. Each index provides three options allowing investors to balance reduction in carbon exposure against tracking error (standard deviation from performance of the conventional portfolio). Custom variations based on the Rankings can also be created to suit specific investor requirements.

ET Low Carbon Tracker Index Series: 25% reduction in emissions versus the conventional index. Very low tracking error – suitable for pension funds and other tracking error constrained investors.

ET Low Carbon Benchmark Index Series: 50% reduction in emissions versus the conventional index. Low tracking error based on balance between carbon reduction and deviation from the conventional index.

ET Low Carbon Transition Index Series: 75% reduction in emissions versus conventional index. Medium tracking error – focused on carbon reduction.

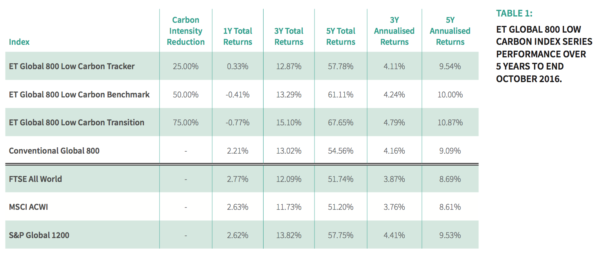

Table 1 demonstrates that ET Low Carbon Indexes can achieve very significant reductions in carbon emissions while generating similar returns to the conventional indexes they track.

It compares the performance of a conventional index of the world’s 800 largest listed companies with three ET Low Carbon Indexes investing in the same companies, but adjusting their weightings based on their position in the ET Global 800 Carbon Ranking. All three weighted indexes delivered better returns over five years and two outperformed over three years.

The Engaged Tracking approach can be used to create low-carbon versions of any index. Other global indexes such as the FTSE All World, MSCI All Country World Index and S&P Global 1200 achieved similar performances over the same time frame as the ET Global 800 Low Carbon Index Series, highlighting the potential of the ET Global 800 Low Carbon Index Series as a viable index benchmark.

Read the full 2016 ET Carbon Ranking report here view the full set of ET Carbon Rankings online here.

By Sam Gill, CEO of ET Index Research

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future