Economy

Wonga (5,853% APR), Wongate, Wronga or just plain wrong

Back in the mists of AD2008 a conference was held at the IMAX in London by the now defunct enterprise Library House. The event had a panel discussion entitled Surviving the carnage, chaired by Charles Cohen of Probability. One of the panellists was Errol Damelin, the Wonga founder (and “loan shark”, as Cohen provocatively labelled him).

I was in attendance, and what was most fascinating about Wonga’s presentation was the mixed feelings of the audience.

There was clear excitement about a brilliantly executed and elegantly designed online lending tool that stripped out the tedium, bureaucracy and tardiness of traditional lenders. In equal measure, there was semi-revulsion at what amounted to an online ‘loan shark’. Even the hawkish and astute capitalist Doug Richard (now of School for Startups), founder of Library House, could not help but express surprise and disbelief at the APRs.

Damelin’s strong projections of substantial profits assuaged most investors’ doubts. It certainly assuaged any usury-is-sin doubt of the Church of England’s money managers. Fast-forward five years, Wonga and the church are making headlines for all the wrong (or wong) reasons.

Stella Creasy MP, a victim of recent online trolling over women on banknotes, has been waging a tireless battle against high interest rate payday lenders. We have covered the archbishop of Canterbury’s unfortunate clerical misstep over Wonga and his excellent claim of ‘competing it out of business’, versus the less-than-excellent fact that the Church of England invested in Wonga when it was a start-up.

Never one to avoid a fight, the Evening Standard’s editor Sarah Sands decided to stand by the “lean and watchful” CEO of Wonga in a strong defence of the “dynamism” of online loan sharking. I have an affinity for Sands as we were both fired under the rein of Charles Moore. We parted company thereafter.

According to Sands, “Dynamic Wonga has spotted a shift in society”.

In reality, it has done nothing more than taken one of the oldest industries in human history and translated it online. The shift they may have spotted was desperation and deprivation. Apparently, Damelin has “fizzy new ideas” on education now. Lock up your children, readers.

“The conflicts of capitalism should not be such a source of moral anguish for the business secretary, whose title suggests he is a champion of business”, Sands witters on.

“This includes encouraging entrepreneurs to set up companies, create jobs, drive growth and contribute to the Treasury. Cable has been campaigning for banks to lend to small businesses. Well, welcome to the world of Wonga. Money lenders have never been popular but legitimate ones keep the economy churning.”

No, no, no.

The rather excellent Martin Lewis of MoneySavingExpert.com gives a more compelling and coherent demolition of Sand’s silliness in the Telegraph (of all places).

In his article, he takes on the archbishop directly over his original claim that, “We’re not in the business of trying to legislate you [Wonga] out of existence, we’re trying to compete you out.”

To Lewis, this is a source of disagreement with the prelate.

“Wonga and other 6,000% APR loans are the crack cocaine of the money-lending world – recent studies even suggest some people are now payday loan addicts”, he writes.

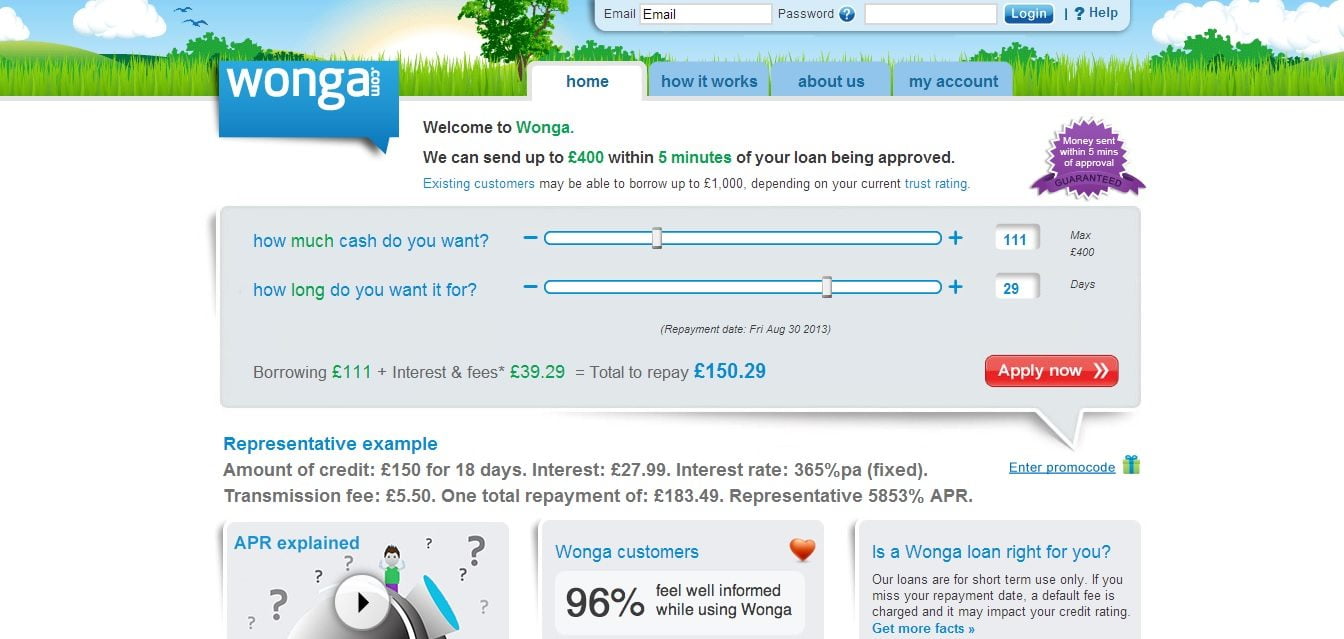

“Lenders use instant apps and fast clicks to target the impulses of the ‘must have it now’ generation. Loans are processed at lightning speed, quick enough for some to apply and receive while drunk.”

While he, like us, praises the archbishop for his aim, ultimately only tight regulation will do. He adds, “We do need tight controls on this industry. Competition from the church is not enough. Costs should be capped, ads banned from kids’ TV, the application process slowed, and mandatory credit checks enforced.”

Making a profit from vulnerable people who lack the financial literacy, which Damelin decries in the coverage of the story, is unethical. Those who can’t see that need to get a grip, demand action from MPs and support Creasy in her campaign.

And finally, the UK’s moral custodians at the Guardian should question who they endorse. Back in 2010, Wonga was considered a sound tech investment and was picked for its “innovation and creativity”.

There is nothing innovative or creative about high interest rate, payday lending, however slick the website and marketing are.

Further reading:

For a church, fiduciary responsibility should not trump social responsibility

Is a little sin tolerable? Ethical investment and searching for the good

Wonga, the archbishop and the Ethical Investment Advisory Group: interview

Archbishop ‘embarrassed’ at Church of England investment in Wonga backer

‘We will compete you out of existence’, Archbishop tells payday lenders