Economy

A simple chart that proves sustainable investment pays off

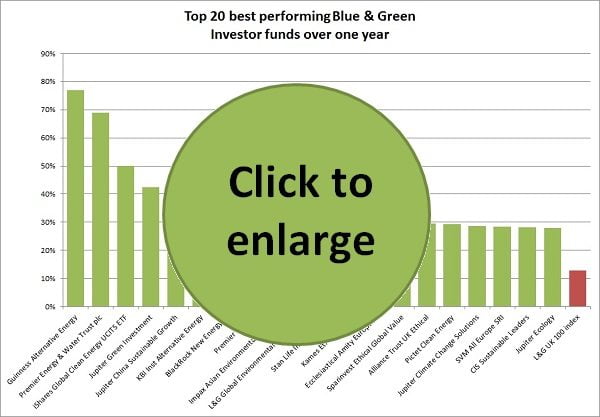

A note to all investors: if your financial adviser or someone else tells you that investing ethically or sustainably is synonymous with poor performance, show them this chart.

In the year to December 17, the best performing fund in the Blue & Green Investor fund library – Guinness Alternative Energy – returned an impressive 77.03%. The average total return for the top 20 is 37.33%.

The Guinness fund invests in those companies where 50% of their business is in the alternative energy sector. This means companies involved in business relating to energy from non-fossil fuel sources and companies involved in efficiency improvements. In addition they must be quoted on a recognised investment exchange and have more than $100m in market capitalisation.

It’s interesting to note that only one of the top 10 – Premier Ethical – that implements negative (ethical) screens in addition to positive screens. This means it excludes certain sectors (known as ‘sin stocks’) and seeks out the most sustainable companies.

The naysayers and sceptics will no doubt reply, “Maybe so, but what about their performance over a longer timeframe?”

It’s true that some of the funds in the top 20 for one year have perhaps not performed brilliantly over, say, three or five years. But for enlightened sustainable investors, past performance is not a major factor. It is future performance that matters most, as sustainability becomes a more pressing issue and a more dramatic pressure on economic success.

A clean energy fund may have faltered over five years, while funds full of fossil fuel stocks skyrocketed, for example. But given what the science tells us about climate change, and what economists say about high-carbon assets becoming stranded (fossil fuel reserves that cannot be safely burnt), which of the two do you think is a better long-term investment?

Note: inclusion of L&G UK 100 index is an indication of how the UK equity stock market has performed over the same period.

Note: inclusion of L&G UK 100 index is an indication of how the UK equity stock market has performed over the same period.

These stranded assets, transparency, triple bottom line fiduciary responsibility, true and fair fees and corporate governance will all have a material effect on investment performance as we enter 2014 and beyond. Environmental and social impacts will have a greater influence as digitally-connected, socially-conscious investors enter the market, and we reach the limits of inexorable growth.

Companies, and the funds that invest in them, will increasingly be punished by their consumers, suppliers, competitors, law firms, governments and investors if they act unsustainably. The reckless profiteering of a more buccaneering financial capitalism may have finally had its day.

Please note that in accordance with the Financial Services and Markets Act 2000, Blue and Green Communications Limited does not provide regulated investment services of any kind, and is not authorised to do so. Nothing in this digital magazine and all parts herein constitutes or should be deemed to constitute advice, recommendation, invitation or inducement to buy, sell, subscribe for or underwrite any investment of any kind. Any specific investment-related queries or concerns should be directed to a fully qualified financial adviser.

Further reading:

Financial returns from ethical investment funds ‘better than mainstream’ in last 12 months

63% of UK investors want to be offered sustainable investment options

Environmental investment stocks outperform industry average over one year

Sustainable and ethical investors honoured at Investment Week Awards