Features

Sniping at ethical investment is an odd sport during National Ethical Investment Week

Every autumn, the financial press spends seven short days focusing on ethical investment. The rest of the year, it returns to writing about the business of screwing over people and the planet for a percentage (or often a fraction of a percentage) of profit. Despite just 2% of the year spent covering the themes and nuances of ethical investment, the odd troll and article creeps out that pours scorn on the whole thing.

If you invest solely for profit maximisation, then look away now, as Blue & Green Tomorrow is going to let you into a little secret that might surprise or even shock you. It’s a big one, so steel yourselves.

People who invest ethically… do so for ethical reasons. The clue, as it were, is in the name.

There, we told you it would surprise or shock you.

There are large of numbers people who invest solely for profit, regardless of the consequences or costs. There are a smaller number of more enlightened and engaged investors, who consider the planet and people, too.

Focusing on returns, performance and profit ignores the more balanced, some would say more sustainable, consideration of planet, people and profit that ethical investors choose to make

Just as there are people who bank ethically, travel responsibly or use clean energy, there are those who choose to invest ethically – for ethical reasons.

We highlighted a partial journalistic hatchet job earlier this week. The rather more impartial Dan Hyde of This is Money acknowledged that “some of the biggest ills in the modern world have been caused by a narrow focus on profit at any cost”. He then points out that “ethical funds have a sluggish record” when it comes to performance.

If ethical investment isn’t ‘strangling returns’ in one article, it’s delivering ‘sluggish’ ones in another.

This ‘strangling’ and ‘sluggish’ record is a debatable fact, as analysis by Worldwise Investor has shown us. Nevertheless, performance at any cost is not the only focus of ethical investors.

If, like us, you accept Hyde’s first argument that some of the biggest ills have been caused by a narrow focus on “profit at any cost”, you might feel tempted to ask the question, “Is there an alternative?” And you, like us, probably want the answer to be ‘yes’, which is the very essence of National Ethical Investment Week; to explore alternative, less harmful investment strategies.

But before we can even consider the alternatives and nuances in any depth, the cold water of “sluggish returns” is always, and erroneously, poured on the debate.

Only chocolate or only celery

Hyde uses a metaphor of choosing chocolate or celery to illustrate the dilemma for investors between doing what is right and what is most profitable. He makes our point for us perfectly. Chocolate is an unhealthy indulgence and celery is the healthier option. Chocolate is great, some would say divine, in small fair-trade doses, but celery is clearly better for you.

The problem with this rather excellent metaphor, writ large from an investment perspective (financial trades that outstrip real world trade 26:1), is that we are pursuing an unhealthy indulgence on a planetary scale.

People are dying right now, because of what we invest in, biodiversity is being destroyed and we are rapidly depleting the finite resources that our economy depends on. All of this leaves an ecological and economic disaster for our children. We are living wholly on a diet of chocolate. And it’s making us, our children, our economy and our planet sick.

Research is the key

Recognising these motivations and differences would surely be sensible in any well-researched article on the subject. There are 137 funds with intelligent and articulate managers to interview; there are nearly 60 specialist financial advisers who have thousands of clients; a handful of open and honest industry bodies with tonnes of statistics and 750,000 investors who invest in this way.

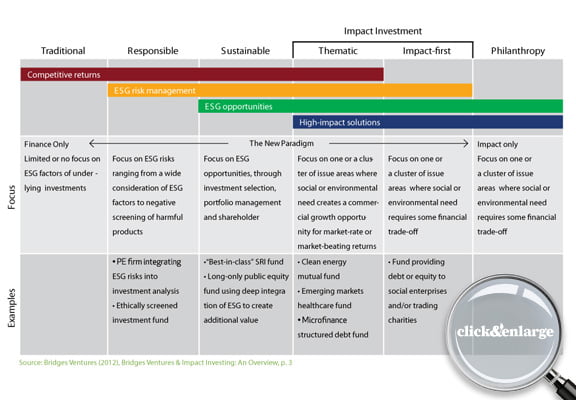

Those nice people at Bridges Venture published an excellent diagram in a recent report that illustrates the continuum from traditional investment, based on securing competitive returns, all the way through to philanthropy, based on little or no financial return.

Commentators who focus solely on profit are missing the point entirely

Ending every article about ethical investment with dire warnings about ‘strangling returns’ and ‘sluggish performance’ misses the whole point.

Focusing on returns, performance and profit ignores the more balanced, some would say more sustainable, consideration of planet, people and profit that ethical investors choose to make.

Some investors hold religious beliefs which forbid certain investments, and it is probably not wise to attack people’s faith so casually; especially when the outcome of those beliefs is a less harmful style of investment.

Some investors have strong moral convictions and would feel uncomfortable investing in something that they profoundly disagree with. We can see no harm in excluding things you find morally repugnant. In fact, it would be very odd indeed to invest in things that you do think of in this light.

Others see mature mining and energy-intensive industries as poor long-term investment options. They see innovation in healthcare and clean technology as a better place for their money. Again, this is a perfectly logical response to a devil-may-care attitude to investment that has historically contributed to the “biggest ills in the modern world”.

Profit at any cost is not the only show in town

Of course, we would all make a lot more money – millions do – if we only invested in oil and gas, mining, alcohol, pornography, gambling, tobacco and weapons. But we choose to avoid these and focus on companies that are developing new jobs and industries, protecting society, the environment and their own workforces, and still returning a profit.

As long as commentators with a lot of influence and reach talk the ethical sector down in overly-brief articles, often littered with misinformation and quotes from the uninformed, it will struggle to thrive

Markets are based on confidence. Investors can be confident that in the short-term, oil, gas and mining stocks are safe bets.

Global energy and consumer demand is rising and supply is becoming harder to maintain. Our current economic model relies on oil, gas and minerals.

As long as tobacco companies find new territories to sell cancer sticks, with no public health programmes, they too will be highly profitable.

Demand for porn, gambling and alcohol is pretty resilient, despite the enormous human cost and cost to public health systems. Humans being humans, we’ll keep fighting wars.

Yes, all these options maximise your profit. But, the future that investing in these stocks creates is disastrous for the long-term.

We shouldn’t forget that governments around the world are tinkering with tax breaks in renewable energy, in particular, making it hard for investors who favour clean and limitless energy to gain regulatory certainty.

There’s nothing arbitrary about National Ethical Investment Week; it’s a chance to explore the issues with a little depth, in the same vein as Fairtrade Fortnight and Move Your Money month.

As long as commentators with a lot of influence and reach talk the ethical sector down in overly-brief articles, often littered with misinformation and quotes from the uninformed, it will struggle to thrive.

But the long-term prospects are bright for ethical investment. Worldwide, the sector enjoys strong in-flows of funds, especially from high net-worth investors. It will also become an increasingly necessary style of investment, as Hyde rightly acknowledges, “Economies in Asia and around the world may well have to turn to alternative energy if oil, gas and other fossil fuels start to run dry.” But stocks cannot thrive when confidence is weak.

Of over 3,000 funds available, only 137 fit into the ‘ethical’, ‘responsible’ to ‘impact-first’ category.

We genuinely wish that the financial press would focus their quality writers, significant influence and huge reach on investigating the massive and real harm the majority of funds are doing to our environment, society and economy, rather than sniping at those that aspire to do some good.

National Ethical Investment Week runs until Saturday, October 20. Join the movement on Twitter using the hashtag #NEIW12.

National Ethical Investment Week runs until Saturday, October 20. Join the movement on Twitter using the hashtag #NEIW12.

If you would like to know more about the sector and receive copies of our most recent reports, you can sign up to our weekly newsletter here.

Further reading:

Ethical investors are not tree huggers, but air breathers (and responsible global citizens)

Are we investing in the future we want for our children and grandchildren?

Ethical investment demand rises as individuals turn to sustainability

Talk of high returns amongst ethical investors detracts from the point

£11 billion invested ethically in the UK: infographic analysis