Economy

Would sustainable investments survive a stock market crash better than unsustainable ones?

The answer to the headline of this piece is, at the moment, no. But it’s the wrong question. The current investment risk is systemic. Sustainability means that our economy, ecology and society are interconnected and need to be in balance. The risk to the system is the dominance of unsustainable economic activity at the expense of sustainable alternatives, and the irreversible harm being done to our environment and society.

This week we passed the point at which the Earth can, for this year, no longer sustain current levels of consumption – an event occurring earlier and earlier each year. We will overshoot Earth’s viability by 37% in 2013, during a period of relatively sluggish economic growth. We blow the planet completely if the global economy recovers.

In a recent speech, Financial Times sage Martin Wolf clearly articulated the continuing global debtor-saver imbalances between developed and emerging economies, over-leverage in banking (finance represents 20% of the FTSE 100) and the continuing failure to address climate change.

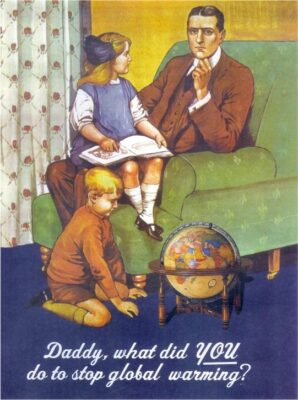

Until the over-consumption of resources and instabilities in capitalism and the environment are addressed, another crash is inevitable and will probably make 1929 and 2008 seem like walks in the park. This is not an inheritance we at Blue & Green Tomorrow, along with many others, wish to leave future generations.

But there is an alternative. And it takes political leadership, corporate responsibility and individual acts of enlightened self-interest.

What do I do?

What do I do?

The threat to our way of life is greater than any since 1939. We are at war, and for us, it’s not the planet that is the enemy.

Punish any politician, media operation or business that lies or fails to act on climate change. Look in the mirror and ask if what you’re doing is harming your children and their children’s future.

“Daddy, what did YOU do to stop global warming?”

Use your vote sustainably

Do not vote for a politician unless they affirm their commitment to sustainability. The fossil fuel mafia has infiltrated and taken over parliament. By voting Green, you may find that you have more friends that you thought.

Here’s a handy list of names to avoid, courtesy of the Campaign against Climate Change: “Peter Lilley, Christopher Chope and Andrew Tyrie, as they all voted against the Climate Change Act 2008. However, they are not the only sceptics in parliament. Other Conservative members include John Redwood, Douglas Carswell, David Davis and previously Roger Helmer (now UKIP, as of March 2012). From the Labour Party, the key name that arises is Graham Stringer.”

Read about sustainability in Blue & Green Tomorrow and please, please spread the word (like us; follow us)

Do not buy the Telegraph, Times, Sun, Daily Mail or Daily Express or their Sunday stablemates. These newspapers are spreading disinformation (deliberate misleading) to protect their own economic self-interests from fossil fuel advertisers. If you believe that climate change is not caused by human activity, you are reading the wrong newspapers by choosing one of these.

Use your money sustainably

In terms of consumption, switch to Good Energy, travel responsibly, spend ethically and invest sustainably.

Anything a government, company or individual does to reduce systemic risk through improved sustainability is a step in the right direction.

Could the infant sector that is sustainable investment survive a stock market crash similar or larger than 2008? We’re not sure that there would be much left of anything in those circumstances, as unsustainable and reckless investors will drag everyone down with them.

Sustainable innovation equals sustainably growth

All that said, innovation leads to growth. Sustainable innovation could lead to sustainable growth. Clean technology is one such innovation. A fossil fuel economy is an 18th century economy and this is the 21st century – renewable energy, energy efficiency and carbon capture could be the major industries of the future – harnessing our ingenuity and creativity and natural resources, creating valuable exports today and making our economy energy self-sufficient in the future.

The answer therefore, is not to do nothing. Vote, spend and invest sustainably.

Yes, we may be fighting the long defeat. The forces arrayed against us are formidable and see vast short-term profits in exploitation, pollution and waste. The odds are against us and the situation is grim. The media and political class have been weighed, measured and bought wholesale. Never in the field of human endeavour has so much been owed by so many and so much owned by so few.

Powerful people and corporations will make us claw any viable future out of their cold dead hands. They need to win at any cost so that their rapacious, unsustainable machine can continue rolling forward, crushing anyone and anything that stands in the way.

We must not let them win. There is a chance, however slim, as long as we act today.

Over to you.

Further reading:

Not over the long-term? Unsustainable investment’s ‘black swan’ moment

Are capitalism and conservation incompatible?

Climate change aside, we’re harming our children with dirty energy