Editors Choice

Why Should Companies be Required to Reveal Their Scope 3 Emissions?

Businesses are increasingly cautious about their greenhouse gas footprint and face greater risk due to the visible impact on climate. Stringent legal and regulatory norms to steer the economy away from fossil fuels have forced investors and other market participants to shift their focus on this.

According to research, 95% of CEOs say that low carbon emissions impact a customer’s buying decision. This shift in end-customer focus directly impacts the company’s profitability, long-term resilience, and risk profile.

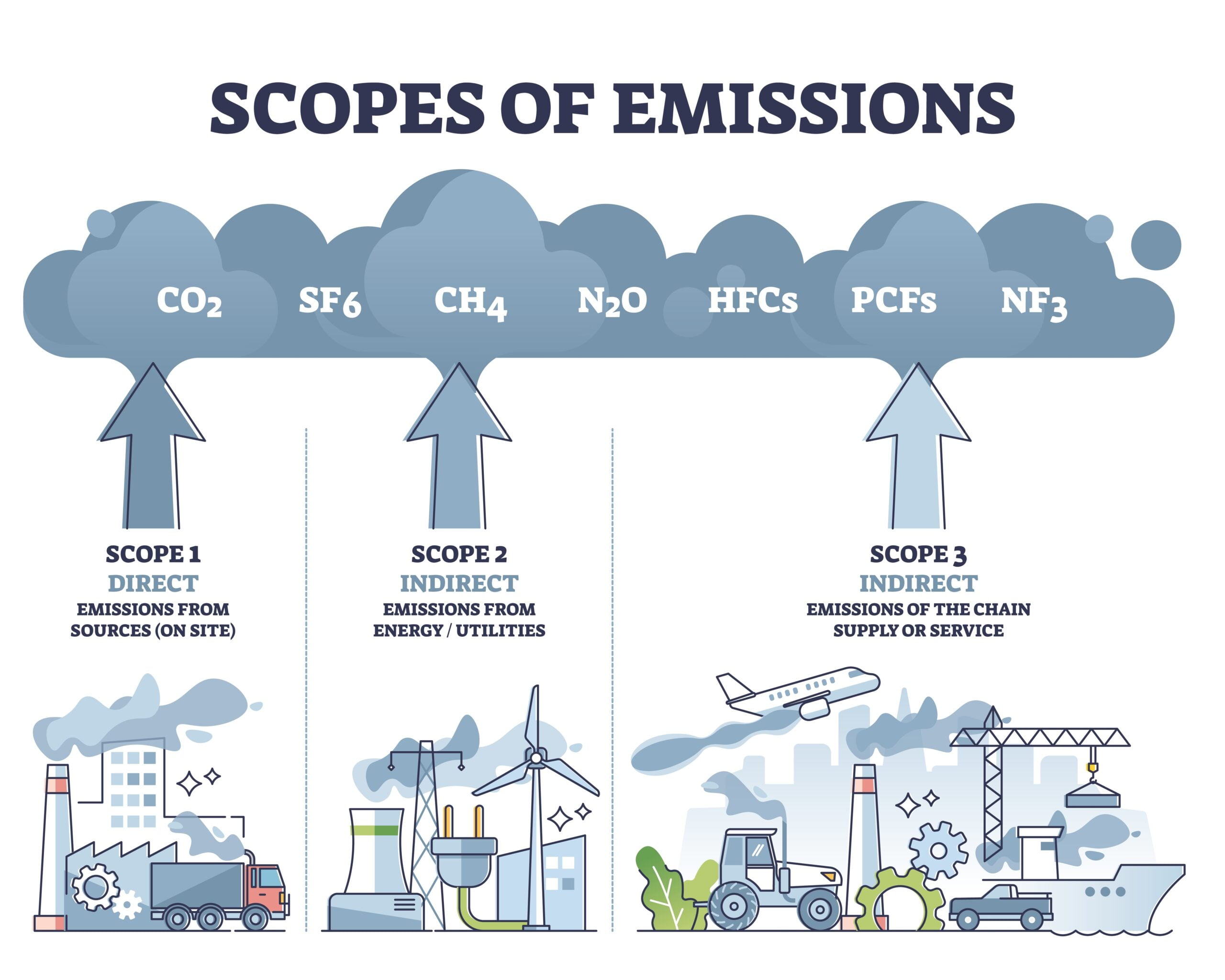

While the Scope 1 (direct) and Scope 2 (Indirect) emissions are immediately visible, businesses need to also account for Scope 3 emissions from the supply chain.

What Is Scope 3 Emissions?

Scope 3 emissions refer to the indirect greenhouse gas (GHG) emissions that occur throughout the entire value chain of an organization but are not directly owned or controlled by the organization. They encompass all the emissions associated with a company’s activities outside of its operational boundaries, including both upstream and downstream activities.

Scope 3 emissions are the risk to the climate hidden in the company’s value chain due to the movement of goods upstream and downstream. The upstream emissions could include:

- Capital and purchased goods.

- Activities that consume fuel and energy.

- Transportation and distribution of goods.

- Waste generation from operations.

- Business travel of company’s employees.

- Daily commuting to the office.

- Leased assets.

The downstream emissions include:

- Transportation and distribution to wholesalers and retailers.

- Processing of products that are sold.

- End-of-life processing/disposal/recycling of products.

- Leased assets.

- Franchises of the company.

- Investments.

Significance of Evaluating Scope 3 Emissions

Evaluating Scope 3 emissions is significant because it provides a comprehensive assessment of the environmental impact of an organization’s activities throughout its value chain. Scope 3 emissions are indirect greenhouse gas emissions that occur because of a company’s operations but are produced by sources not owned or controlled by the company. They include emissions from the entire lifecycle of a product or service, including raw material extraction, production, transportation, and end-of-life disposal.

Evaluating Scope 3 emissions allows organizations to understand and manage their environmental impact comprehensively, address supply chain risks, meet stakeholder expectations, identify opportunities for innovation, and align with climate goals. It is an essential step in transitioning to a more sustainable and low-carbon economy.

How Can Scope 3 Emissions Be a Hidden Risk for Investors?

Scope 3 emissions can represent hidden risks for investors due to their potential impact on a company’s financial performance and long-term viability. Here are some ways in which Scope 3 emissions can pose risks:

- Regulatory risks: Stricter climate regulations may impact companies with high Scope 3 emissions, leading to increased costs and operational challenges.

- Reputational risks: Stakeholders’ concerns about climate change and environmental impact can harm a company’s reputation, resulting in revenue loss or brand damage.

- Supply chain risks: Climate-related disruptions and resource scarcity can disrupt the supply chain and increase costs for companies reliant on high-emission suppliers.

- Transition risks: Companies heavily dependent on high-emission industries may face challenges as the market shifts towards low-carbon alternatives, leading to financial losses and stranded assets.

- Investor expectations: Investors consider climate strategies and carbon footprints when making investment decisions, potentially impacting companies with high Scope 3 emissions.

- Litigation and legal risks: Legal action related to climate change and emissions disclosure can result in liabilities, penalties, and reputational harm for companies.

How Do Reporting Scope 3 Emissions Protect Investors?

Reporting Scope 3 emissions can protect investors by providing them with crucial information about a company’s environmental risks, performance, and sustainability practices. By promoting transparency, accountability, risk assessment, and informed decision-making, reporting Scope 3 emissions helps protect investors’ interests and supports the shift towards a more sustainable and low-carbon economy.

Disclosure of Scope 3 Emissions Must Be Standardized

Without a standard regulatory requirement, Scope 3 emission disclosure is likely to be inaccurate. The companies can make statements without data to verify because Scope 3 disclosure is not a part of annual reporting set by external auditors. Unverified claims and narratives could mislead investors and lead to a bigger problem in the future.

Standard methodologies for calculating and declaring Scope 3 emissions are progressing fast. While it is easy for companies burning fossil fuels to calculate the Scope 3 emissions, it may be challenging for financial institutions with a standard methodology.

Staff letters, public comments, and guidance from the industry and investors can expedite the standardization of Scope 3 disclosure.

How Does ESG Consulting Help Drive ESG Goals and Reduce Scope 3 Emissions?

ESG has become an integral aspect of corporate strategy as companies navigate the expectations of investors, consumers, employees, and the government. Embracing sustainability and ensuring business resilience are closely linked, requiring adherence to the United Nations Sustainable Development Goals (UNSDGs) and commitments made at COP26 held in Glasgow in 2021.

By providing strategic guidance, data management expertise, supply chain engagement, risk assessment, and stakeholder engagement support, ESG consulting helps companies drive ESG goals, including reducing Scope 3 emissions. It enables companies to enhance their sustainability performance, manage risks, meet regulatory requirements, and align with investor and stakeholder expectations to pursue a more sustainable, low-carbon future.