Features

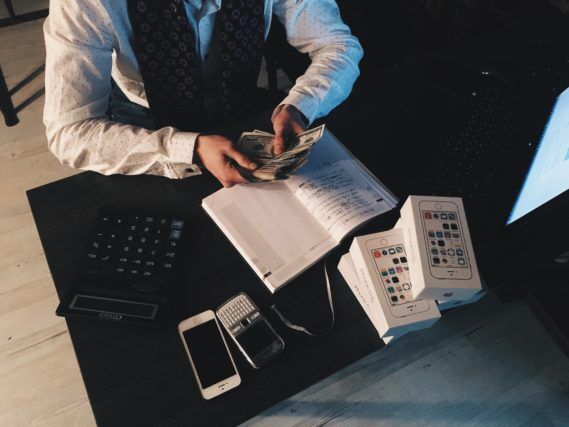

How To Be Financially Prepared At All Times

There are probably few things that provide such comfort as knowing that you have enough money to cover not only all of your immediate needs but all of your potential emergencies as well. After all, many people know all too well what it’s like to work, day in and day out, just to have enough money to live. The good news in this is that with a little work and planning, most people really can have enough to be financially prepared at all times. This article will provide some tips for how you can accomplish that comforting goal.

1. Budget your money

It’s been said so many times but it bears repeating: preparing and sticking to a budget will work wonders for your financial health. A good budget will provide a landscape of your financial picture for a given month. After you have this overall picture on paper, you will know how much you can spend on whatever expense you might have. And once you have spent that amount, you stop. It’s that easy. The trick, however, is to always allocate at least some money from every check to a savings account.

2. Buy your food in bulk

After housing, food is the second highest expense in the lives of most families. Fortunately, when you are careful about what you buy and how much you spend, you can frequently save up to 50 percent on your grocery bills. This can be done any number of ways, including shopping at the so-called big box stores, using coupons, and more. And when you decide to eat out, be careful where you go and what you order to save money. One popular business is Marks & Spencer, which offers frequent specials such as a dine for two for £10. On the other hand, eating at home is not only less expensive but better for you as well.

Use coupon websites like Mamma.com to find discounts on all of your favorite grocery stores, and restaurants.

Check out their list of retailers here

3. Eliminate debt

It might sound obvious to say it, but most people carry too much debt. It’s true that debt might allow you to have many nice things whether you can afford them immediately or not, but the bone-crushing burden of debt is killing us. Why not save all of that money that is spent on interest and put it in your pocket by eliminating all or at least a big portion of your credit cards?

4. Be careful with your money

It might not be as much fun to spend your money more carefully, but when you compare the feeling of having “plenty” with having a large amount of debt, you will find new ways to buy smart. At the same time, it’s also fun to find new ways to save money and know that you are on the way to better financial health in the future.

5. Save

It might sound ridiculously simple, but having a bank account that grows regularly is a big factor in making you feel confident about being able to meet your financial obligations and have plenty left over. Further, with the power of compounding interest, your money will grow at a rate that is much faster than any amount you can save on your own.

6. Be careful of your credit

It might seem like a contradiction, but having enough good credit available to you when you need it is a great way to feel financially prepared. This doesn’t mean that you have to use all of your credit, but when you have enough good credit you can relax knowing that you have enough to cover any eventuality.

By observing these ideas you will find out that being financially prepared is a soft pillow.

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future