Invest

Three days to go: many top ISA stocks fail to deliver sustainability

The ten most popular equities in ISAs this tax year fail to deliver on the sustainability front. Investors still have three days to use up their ISA allowance and make the most of the tax free incentive.

According to The Share Centre, utilities and high street banks both feature in the most popular ISA stocks. Graham Spooner, investment research analyst at The Share Centre, said this year’s most popular stocks reflect a desire for income, as interest rates remain low.

However, investors should consider ethics and sustainability when selecting stocks in order to ensure long-term stability and returns. Several pieces of research has linked sustainability with greater stability and returns, suggesting investors can match their investments to their ethical values without missing out financially.

British drug company GlaxoSmithKline came out as the most popular equity. In July last year the company came under fire over allegations of bribery in China. Despite this investors maintained their trust in the company, which is a popular choice among ethical and responsible fund managers, including Alliance Trust.

Among the top ten were also oil and gas companies BP, Royal Dutch Shell and Centrica. MPs recently issued a stark ‘carbon bubble’ warning to investors and the finance world. A committee said that stock markets are at risk of instability because fossil fuel assets can become overvalued when the need to tackle climate change is factored in.

Such fears highlight the need for investors to be aware of how sustainability issues can impact on their investments in the short, medium and long-term.

Two high street banks – HSBC and Lloyds – also made the top ten list. In the last year HSBC has been accused of a number of unethical and unsustainable practices including “bankrolling the destruction of rainforests” and financing coal mining projects. It has also been embroiled in the rate-rigging scandal and suspended two traders dealing in the foreign exchange market at the beginning of the year.

Lloyds has also come under fire after being accused of short-changing payment protection insurance victims and being fined for an irresponsible sales culture.

The other companies that made the top ten were Vodafone, National Grid, Tesco and Aviva.

Individuals have until midnight on April 5 to use up their ISA allowance – which is £5,750 in a cash ISA or £11,520 in a stocks and shares ISA – for the year 2013/14.

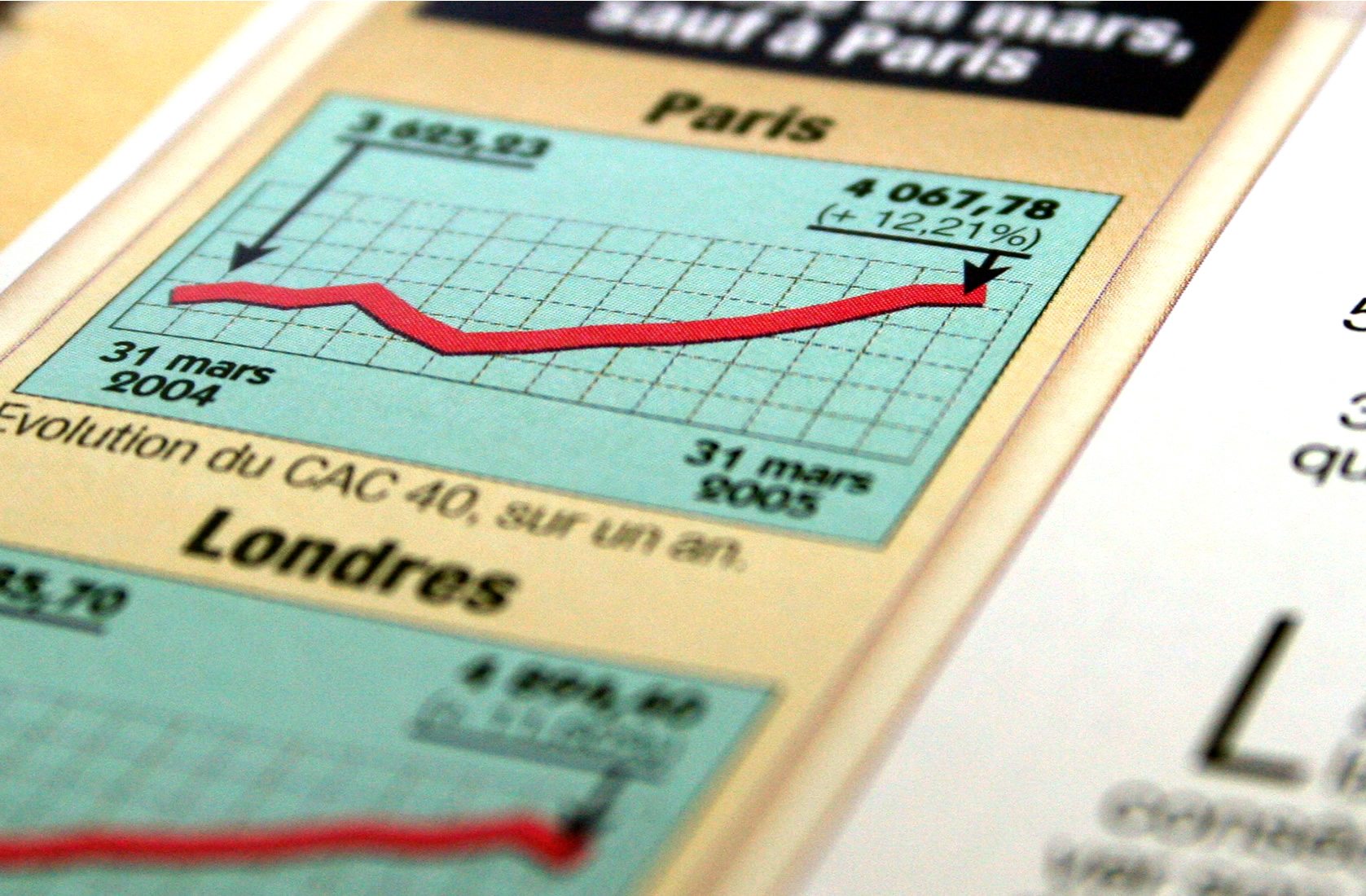

Photo: Pascal THAUVIN via sxc.hu

Further reading:

Four days to go: fifth of ISA investors select stocks ‘blindly’

Five days left until the deadline for investing in 2013/14 ISAs

ISA deadline closes in: have you made the most of your tax-free allowance?

Green ISAs: it’s not too late to resurrect an inspired idea

Consider sustainability and ethics when investing in ISAs this year