Features

Unconscious Competence in Investment: Good Money Week

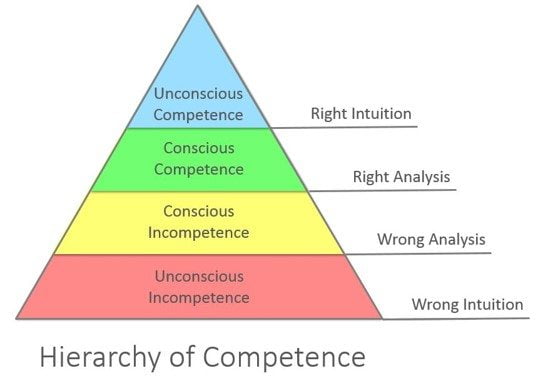

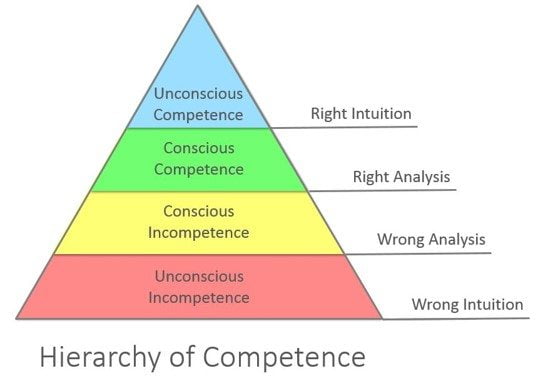

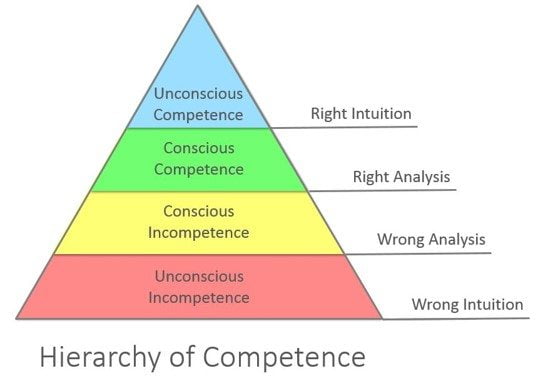

The four stages of competence, or the “conscious competence” learning model (Noel Burch, 1970), relates to the four psychological states involved in progressing from incompetence to competence in a skill. In the run up to and during Good Money Week it’s quite a handy tool to understand where financial advisers are concerning sustainable investment.

Unconscious incompetence – where 80% of financial advisers are re: SRI (socially responsible investing) – The individual does not understand or know how to do something and does not necessarily recognise the deficit. They may deny the usefulness of the skill. The individual must recognise their own incompetence, and the value of the new skill, before moving on to the next stage. The length of time an individual spends in this stage depends on the strength of the stimulus to learn.

– Advisers at this stage will say: “There’s no demand for sustainable, responsible or ethical investment,” or: “ethical investment means compromising on performance,” and the obligatory: “I’ve been advising clients for well over twenty years, leave it to me.”

– What you need to do if you meet an adviser like this: help them recognise their deficit and give them the incentive to move up a stage by refusing to give them your money. These are the kind of advisers who flee if there’s a crisis.

Conscious incompetence – where 20% of financial advisers are re: SRI – Though the individual does not understand or know how to do something, he or she does recognize the deficit, as well as the value of a new skill in addressing the deficit. The making of mistakes can be integral to the learning process at this stage.

– Advisers will say: “So you want to invest ethically. Well it’s not my area of expertise but I’ve read Blue & Green and they have some handy insight that will help us create a portfolio for you. I’ll give my friend at the Ethical Investment Association a call.”

– What you need to do if you meet an adviser like this: encourage them. Point them at 3Dinvesting.com which has all the resources they need to find a selection of appropriate, good performing funds for you.

Conscious competence – where 5% of financial advisers are re: SRI – The individual understands or knows how to do something. However, demonstrating the skill or knowledge requires concentration. It may be broken down into steps, and there is heavy conscious involvement in executing the new skill.

– Advisers will say: “I’ve read the Guide to Sustainable Investment from Blue & Green and have spoken to 3Dinvesting. We’ve come up with a portfolio that meets 90% of your requirements; financially, socially and environmentally – unless you want to stock pick. Let’s go through it, together.”

– What you need to do if you meet an adviser like this: go with it. You’re in safe hands now. Enjoy the joint learning process.

Unconscious competence – where 1% of financial advisers are re: SRI – The individual has had so much practice with a skill that it has become “second nature” and can be performed easily. As a result, the skill can be performed while executing another task. The individual may be able to teach it to others, depending upon how and when it was learned.

– Advisers will say: “Of course you want to invest ethically. It’ll protect you from shocks coming down the line in terms of the carbon bubble, government regulation and citizen activism. I have a 3dinvesting.com model portfolio I use as a starter for ten with most clients. Let’s bespoke it for your goals and needs. My assistant is just learning he rope, do you mind if they join us?”

– What you need to do if you meet an adviser like this: rejoice, you’re finally in the hands of real professional. Pass go!