The UK’s leading market intelligence resource for social enterprise, NatWest SE100, has recognised star performers. Now in its 7th year, the leading market intelligence resource for social...

Key organisations within the social innovation sector have agreed to participate in the Good Deals Conference 2016 – the UK’s leading international conference on social enterprises,...

Latest figures from the NatWest SE100 Index reveal exciting growth for UK social enterprise movement. New figures released today by the NatWest SE100 index highlight impressive growth from...

The Royal Bank of Scotland, which includes NatWest, is the worst UK bank for branch closures new analysis reveals today. The taxpayer-owned bank shut 385 branches...

FRC Group, a social enterprise working to eliminate furniture poverty, has been recognised as a leading social enterprise, winning the Impact Champion award in the 2015...

Now in its 6th year, the leading market intelligence tool for social ventures, the NatWest SE100 Index, is pleased to announce the shortlist for its 2015...

New research has suggested that most customers are choosing to switch current accounts based on the bank’s reputation and customer service, despite larger banks trying to...

Campaign group Move Your Money has launched a crowdfunding campaign to fund its battle with the high street banks. From September, new rules come into effect...

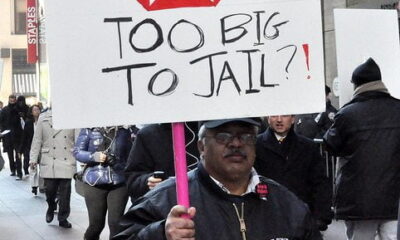

Sending senior bankers to prison for reckless behaviour may not bring about the wholesale positive changes regulators expect, according to the law profession’s trade body. The...

The market share of Britain’s biggest five banks dropped 5 percentage points in 2012, as 2.4 million customers closed their high street accounts in favour of...

The Royal Bank of Scotland (RBS) revealed it made a £5.17 billion pre-tax loss in 2012 – more than three times the £1.2 billion it lost...

With Christmas just days away and a new year around the corner, why not treat yourself to a brand new, ethical, sustainable, responsible and better bank...

Recent debacles in banking from various insurance mis-selling scandals (payment protection and interest rate swaps), on-going IT failures (Natwest) and Libor fixing (Barclays, the first of...

On June 21, Natwest sent me a great bank statement. My personal favourite, I think. No, I haven’t just come into oceans of money. What gave...