Economy

Lords defeat Commons over tax credits

The UK House of Lords has voted to delay controversial cuts to tax credits dealing a major blow to the UK government and Chancellor George Osborne. The vote was carried by 289 votes to 272, providing full financial redress to the millions of recipients affected.

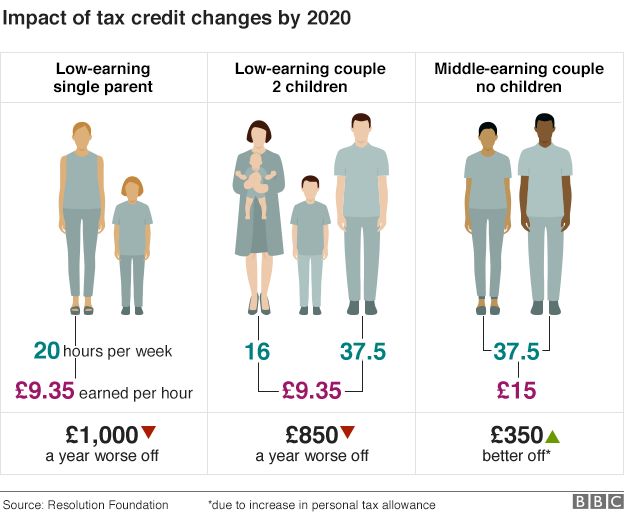

Chancellor George Osborne and his supporters had argued that anyone who is working full-time on the National Living Wage will be better off, after the tax changes are taken into consideration. However most people claiming tax credits are likely to be working part-time.

In an Institute for Fiscal Studies, Summer post-Budget briefing, IFS Director Paul Johnson said: “the key fact is that the increase in the minimum wage simply cannot provide full compensation for the majority of losses that will be experienced by tax credit recipients. That is just arithmetically impossible.”

George Osborne responded to the vote saying: “I said I would listen and we will listen to the concerns that have been raised. I believe we can achieve the same goal of reforming tax credits, saving the money we need to save to secure our economy, while at the same time helping in the transition. I’m determined to deliver that lower welfare economy the British people want to see.”

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy10 months ago

Energy10 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change