Economy

RBS shares down 7.7% after biggest loss since 2008

Shares in the Royal Bank of Scotland (RBS) plummeted on Thursday as the part state-owned bank reported its biggest loss since the 2008 financial crisis.

Shares closed down 7.7% at 326.6p on the day the bank announced annual losses of £8.2 billion. This contrasts with losses of £5.2 billion in 2012. Its share price sat at 500p when the taxpayer bailed it out in 2008.

Ross McEwan, chief executive of RBS said the results were “sobering”. He recently said that the losses were expected to come as a result to “pre-crash times”, blaming them on large bills accumulated in the wake of the PPI scandal, selling toxic mortgage backed loans and rigging interest rates.

RBS was heavily criticised over the announcement, after McEwan defended his decision to pay nearly £600m in bonuses to staff. He told the BBC that in order to retain skilled employees that keep the business running, he needed to pay them “fairly”.

He said, “I know it is hard for people to understand – why on earth would you pay any money on bonuses when we’re losing that sort of money? Underneath that loss, we’ve got a very profitable business where thousands of people operate every day to do good things for our customers and I just need to hold on to those people.”

He added that his mission was to create a bank that the UK “can be proud of”, saying that this should be one that is customer-focused.

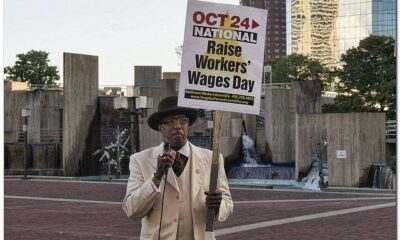

David Hillman, from the Robin Hood Tax Campaign, commented, “Frankly, this beggars belief. In what other industry would staff at a state-owned company that helped bring the economy to its knees be lavishly rewarded for massive losses?

Meanwhile, the Move Your Money campaign pointed out that many consumers were already moving away from the big five banks to one of the 50 smaller and simpler banks across the UK, including building societies, which feature heavily on the campaign’s scorecard. Charlotte Webster, campaign director at Move Your Money, said the changes from RBS were “too little, far too late”.

Further reading:

RBS reports losses of £8.2bn – and employee bonuses of £576m

Royal Bank of Scotland to focus in UK customers and economy

Regulators say Euribor reforms ‘must continue’ following rigging scandal

Royal Bank of Scotland faces losses of £8bn

Cameron defends bankers’ bonuses at RBS after Labour criticism

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future