Economy

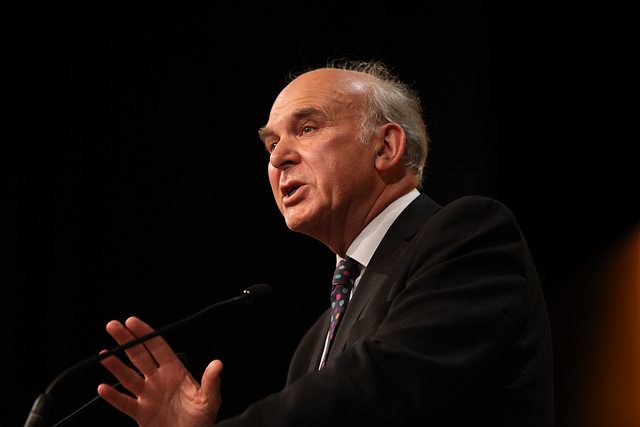

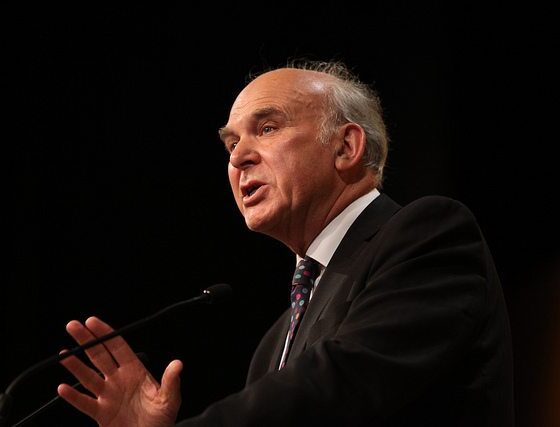

Vince Cable calls on FTSE 100 to create sustainable remuneration packages

Business secretary Vince Cable has warned the remuneration committees of FTSE 100 companies to curb excessive pay packages or risk further action. He argued that more sustainable deals and a focus on long-term goals were needed.

Cable’s comments come ahead of this year’s annual general meeting (AGM) season, which he said the government would be watching. He added that remuneration continued to be the focus of public debate and warned, “Unless business is seen to act responsible, pressure for further action will inevitably result.”

In a letter, Cable added, “I therefore trust that you will seize the opportunity to bring pay in line with performance.”

Previous research found that more than a third of executive directors at FTSE 100 companies have seen their pay and incentives rise at a quicker pace then company performance. The figures highlighted a lack of correlation between financial performance and remuneration packages in many cases.

Cable also added that remuneration should encourage long-term and sustainable growth rather than a focus on short-term gains.

The letter said, “Getting pay wrong damages popular trust in business, and undermines the duty to promote the long-term success of the company.

“I therefore think it vitally important that remuneration committees consider how remuneration policies can genuinely support sustainable value creation and avoid creating unwelcome incentive to focus excessively on short-term goals.”

The banking sector, and in particular Barclays, which will hold its AGM on Thursday, was singled out as having “dangerous levels” of pay. Cable called on the banks to listen to shareholder demands.

Barclays decided to increase it bonuses pool by 10% this year, despite profits falling by 32%. The increased led to increased tensions with shareholders, with some calling for change in the bank’s investment arm. The bank’s chief executive Antony Jenkins, who argued that bonus cutbacks in 2012 led to the business beginning to contract, defended the decision.

In 2012 there was a record number of remuneration reports being voted down by investors, suggesting that shareholders are willing to take action should they feel that pay packages do not represent a company’s performance.

Photo: Liberal Democrats via Flickr

Further reading:

Barclays and BP remuneration packages lead to tough questions from investors

Quarter of financial services firms expect to pay bigger bonuses in 2014

35% of FTSE 100 directors see pay rise quicker than performance

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future