Features

Ethical, responsible, sustainable: what should we call enlightened investment?

The sustainable investment industry has come a long way from its purely ethical roots. No longer is it simply about screening out the bad guys, as has already been shown this National Ethical Investment Week.

Accompanying this shift in purpose and impact is an evolution of name. What was once solely described as ethical investment is now referred to as sustainable, responsible, impact, green and a whole host of other variations.

Each has its own specific meaning, but collectively, the terms form part of the enlightened investment scale, of investment strategies that take into account environmental and social factors, as well as financial ones.

The Quakers – or the Religious Society of Friends – are often said to have devised the idea of investment that isn’t solely for profit. Around the time when slavery was legal in the UK, and investors were profiting from it, the Quakers decided to take a stand and opt to take their money away from the activity.

Theirs was almost exclusively a decision made for ethical or moral reasons, but who is to say that this enlightened group of 18th and 19th century individuals didn’t predict slavery’s eventual abolition and decide to divest from and exclude the practice on the same grounds as 21st century investors are divesting from and excluding fossil fuel stocks because of their impact on global warming?

While it now has several offshoot strategies, ethical investment itself still exists today. A wide range of businesses, charities and retail investment funds place negative screening at the centre of their portfolios, excluding sectors and companies that may be contradictory to their core aims (or not, in some cases). The classic example is a cancer charity excluding tobacco firms.

Well-meaning retail investors have perhaps been harshly treated by onlookers over the ethical investment funds they invest in, which while excluding animal testing and arms manufacturers, for example, may have large holdings in fossil fuel firms like Shell and BP.

These funds attract a certain amount of negative press, and prompts media outlets to ask silly questions like, “Can investments ever be ethical?” The answer, of course, is yes they can, but the key point is that ethics are very much personal.

Some funds however are very ethical, or dark green. They historically focus more on the environmental or social good (or rather, the lack of environmental or social bad) they do.

Speaking to Blue & Green Tomorrow, Mike Appleby, a sustainable and responsible investment (SRI) analyst at Alliance Trust Investments, said this type of ethical investor “has been slightly neglected over time because it’s not fashionable to talk about ethics and negative screening”.

He added, “At the ethical end of the spectrum, a lot of people are judging how good the fund is by how much of the benchmark gets excluded. And that’s fine. There are lots of people there, and that’s actually where the origins of the industry are.”

Towards the middle of the enlightened investment spectrum are funds that exclude certain areas, but also select stocks through an environmental, social or governance (ESG) lens. Then at the other end, also called light green, are those that have very loose screens and/or ESG criteria. The latter set of funds often prefer to use their investment clout and engage with some of the historically unethical or unsustainable industries, in order to effect positive, sustainable change from within.

Alliance Trust runs a range of Sustainable Future funds and is one of the industry leaders in sustainable investment. Appleby said, “Too much time is devoted to trying to define, and then two years later redefine, what different flavours of sustainable investing are called.

“I do think that it’s important that if a fund says it does include sustainability in the investment process, it has to be very clear and transparent about its criteria and how it is applied. We take this one step further and disclose all holdings in our Sustainable Future funds so investors know exactly where their money is invested.”

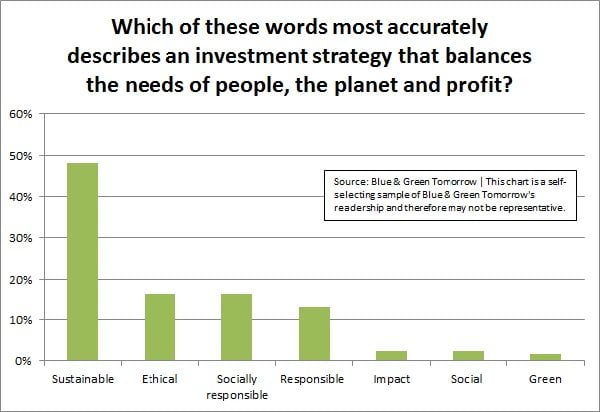

It may be National Ethical Investment Week (NEIW), but a Blue & Green Tomorrow poll, which was conducted with a self-selecting sample of our readership and therefore may not be representative, suggests that ‘ethical’ is perhaps an outdated term.

Nearly half of respondents said ‘sustainable’ was the term that most accurately described an investment strategy that balances the needs of people, the planet and profit. ‘Ethical’ was joint second with ‘socially responsible’, recording just over 16% of votes.

Nearly half of respondents said ‘sustainable’ was the term that most accurately described an investment strategy that balances the needs of people, the planet and profit. ‘Ethical’ was joint second with ‘socially responsible’, recording just over 16% of votes.

“There are questions about its name, but NEIW is a useful forum, as long as people understand that all types of sustainable funds, cleantech funds, ethical funds and so on will be under that banner”, said Peter Michaelis, head of SRI at Alliance Trust.

“If that’s the case, I don’t think the naming matters.”

Speaking at a NEIW event hosted by FT Adviser on ethical and sustainable investment, James Cameron of Climate Change Capital spoke of his experience with the naming of the industry.

“I founded Climate Change Capital 10 years ago in order to channel capital into the highly complex, highly distributed problem of climate change, in ways that could resonate with mainstream investors and didn’t need a label of ethical investment or socially responsible investment but in fact was”, he said.

“We invented for ourselves the idea that we were creating wealth worth having.

“It is possible to build an investment strategy that doesn’t have any of these labels, that does fit with the needs of institutional investors and indeed with governments who change their mind from time to time on whether they want to be green or not, and does over time – and that’s a key factor – deliver real and lasting benefits to society.”

National Ethical Investment Week 2013 runs from October 13-19. Join the debate on Twitter using the hashtag #moneydoinggood.

Further reading:

‘Positive’ investment worth £1.6bn in the UK

63% of UK investors want to be offered sustainable investment options

£11 billion invested ethically in the UK: infographic analysis

Survey: environmental issues concern ethical investors the most