Features

3D Analysis: What do SRI funds invest in in the UK?

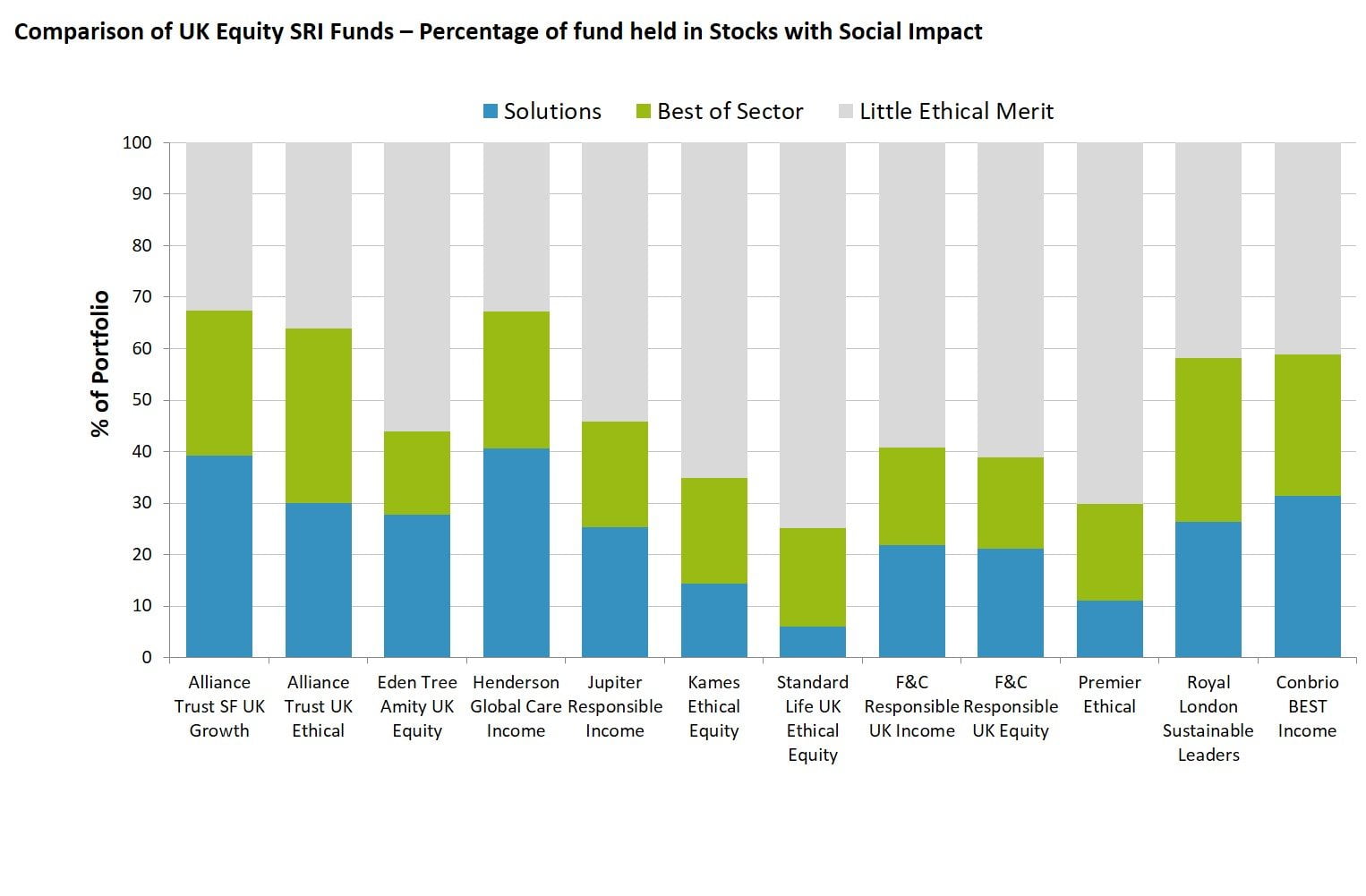

Our SRI analysis partner 3D Investing compared 10 of the most noteworthy SRI funds investing in UK equities to see which ones invest the most in companies that actually make a positive difference.

3D Investing is a distinctive investment approach that seeks to maximise social impact, to minimise ethical compromise and to deliver on financial expectations. It is an evidence based approach that analyses the constituent holdings of each and every investment, so that investors can be confident that their money is being used in a way that really does make a social difference whilst meeting their financial needs.

The evidence-based approach means that, not only can investors be assured of successful financial outcomes, but they can be equally confident in maximising the social impact of their portfolio. Too many ethical portfolios invest in companies that investors would find unacceptable if only they knew, and the social impact is often tokenistic. 3D investing involves a fully transparent process, making any compromises clear and seeking to maximise social impact and to inspire investors.

3D Investing has categorised every holding in SRI funds investing in UK equities as follows:

Solutions – the core product or service is of social or environmental benefit, e.g. healthcare, clean energy

Best of class – the company demonstrates leadership in its sector in terms of social and environmental performance

Little ethical merit – there is no clear environmental or social value from the company’s activities

We would anticipate any fund using responsible, ethical or sustainable in its messaging and proposition to invest the majority of assets under management in companies that actually make a positive difference.

Of the results independent SRI consultant John Fleetwood of 3D Investing said: “The majority of the funds analysed had less than half of their portfolio in companies that actually make a clear social or environmental difference, including some big names in the industry. However, there are UK equity funds which do deliver on the expectations of socially motivated investors. This research clearly identifies those funds.”

To find out more about 3D Investing click here.