Economy

New plans to boost HMRC’s tax powers contradict Magna Carta principles

Eamonn Butler, director of the Adam Smith Institute, writes how new planned powers for HMRC flout crucial Magna Carta principles.

Plans to allow Britain’s tax authorities, HMRC, to take money directly from the accounts of tax delinquents have been criticised by a committee of MPs on the grounds that HMRC “sometimes makes mistakes“.

A sharper criticism would be that the plan is a fundamental assault on the rule of law.

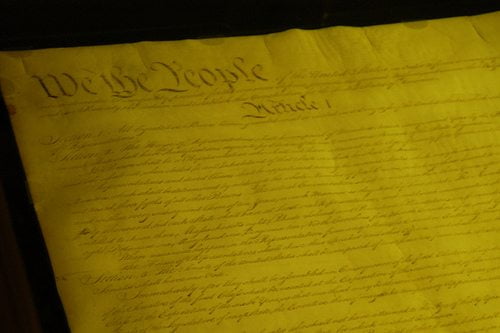

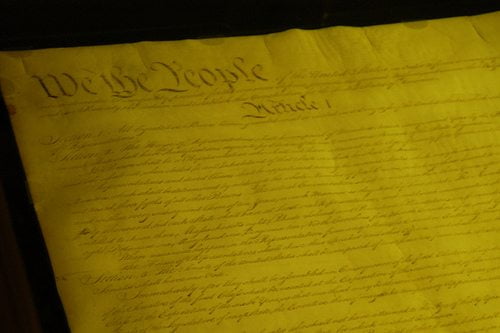

Next year is the 800th anniversary of Magna Carta, but the basic civil protections it gave citizens against arbitrary power are being systematically eroded. Governments have become elected dictatorships.

Magna Carta laid down that there could be no taxation without the “common consent” of the people. It also insisted that no official can take anything from a person – nor fine them, nor imprison them, nor “in any way destroy” them – without due process of law. Right now, the tax authorities would have to apply to the courts before they could take cash or other assets from a citizen.

But the new HMRC plans flout both these Magna Carta principles. HMRC can already decide that someone owes tax that they have deliberately ‘avoided’ – even if they have complied with every tax law.

This is arbitrary power that we cannot safely entrust to any official. Reinforcing that power with further powers of confiscation – in the absence of any magistrate or court decision – is even more dangerous.

The MPs are right that even fair-minded officials make mistakes. Worse, the new plan passes the burden of proof – and the costs of proving it – from the authorities to the citizen. That again is contrary to the fundamental principle that people are innocent until proven guilty.

HMRC says that the new powers would be used only in extremes. But then it says that it expects perhaps 17,000 people will be affected each year.

Many of them will, of course, be people who are completely innocent and the subject of official mistakes. Some will see their businesses ruined, and their employees losing their jobs, because of officials arbitrarily raiding their accounts. Others, worryingly, will be people who the authorities decide to bully and make an ‘example’ of just because they are well-known.

Recent history – like people being arrested under terrorism legislation for heckling the home secretary or walking down a cycle path – shows that when you give officials sweeping powers, they will be used. And when you exempt them from the rule of law, those powers will be abused.

Eamonn Butler is director of the Adam Smith Institute, where this article originally appeared.

Photo: sherrymain via Flickr

Further reading:

MPs raise concern over HMRC’s new tax powers

Oxfam: corporations fuel ‘vicious cycles of inequality’ through tax rules

HMRC sets sights on offshore accounts

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy10 months ago

Energy10 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change