Invest

MSCI launched series of low carbon indexes for investment decisions

MSCI, a provider of investment decision support tools, has announced the launch of the MSCI Global Low Carbon Leaders Indexes. The new index will consist of companies with significantly lower carbon exposure than the broad market.

Blue & Green Tomorrow is currently running a crowdfunder to ensure its survival. Please pledge.

The indexes were created at the request of and with insights from Fourth Swedish National Pension Fund AP4, Fonds de Réserve pour les Retraites (FRR) and Amundi. The asset owners wanted representative benchmarks in the transition to a low carbon economy and their demand shows how considering sustainability factors is material and moving into the mainstream.

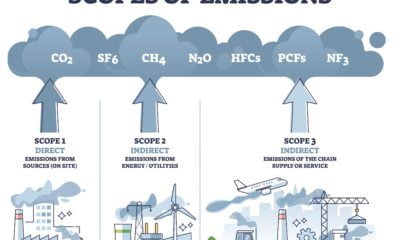

The new tools look at to areas of carbon exposure – carbon emissions and fossil fuel reserves – and aim to provide clients with an effective tool for limiting the exposure of their portfolios to carbon risk.

Yves Chevalier and Oliver Rousseau, members of the FRR executive management board, said, “These low carbon indexes are a promising avenue that can bring increased awareness among listed companies that carbon is a major issue for a large investor community, for environmental as well as financial reasons.”

Recent reports have warned of the investment risks when placing money in fossil fuels as emission restrictions are tightened and governments work towards climate targets. Companies with high carbon emissions could also be affected as new carbon cutting goals are imposed, potentially placing investor money at risk.

Achim Steiner, executive director of the UN Environment Programme (UNEP) and UN under-secretary general, commented, “From a UN perspective decarbonising the portfolios of institutional and retail investors worldwide can be a powerful conduit to realising low carbon economic growth.

“Though its Finance Initiative, UNEP encourages, supports and facilitates financial innovation that enables a systematic ‘greening’ of the world’s financial markets. This series of low carbon indexes is a prime example of such leading innovation that we look forward to helping catalyse and mainstream in months and years to come.”

Photo: Ken Tegardin via Freeimages

Further reading:

MSCI launches tool to support fossil free investment

Is it right to invest in an FFFF (Fossil Fuel Free Fund)?

Investors committing to fossil fuel divestment face challenge in finding alternatives, says study

MSCI seeks to strengthen ESG investment research with acquisition

Church of England and MSCI team up for ethical investment screening