News

The ‘Tipping Point Effect’ Of Women On Boards And Financial Performance

Having three female corporate board members reflects an influential ‘tipping point’, that can be seen in terms of financial performance, an increasing amount of research now suggests.

Our analysis from last year looked at a snapshot of global companies in 2015 with strong female leadership, finding that they enjoyed a Return on Equity of 10.1% per year versus 7.4% for those without such leadership.

This year, we analysed U.S. companies over a five-year period (2011-2016). U.S. companies that began the period with at least three women on the board experienced median gains in Return on Equity (ROE) of 10 percentage points and Earnings Per Share (EPS) of 37%. In contrast, companies that began the period with no female directors experienced median changes of -1 percentage point in ROE and -8% in EPS over the study period (see below exhibits).

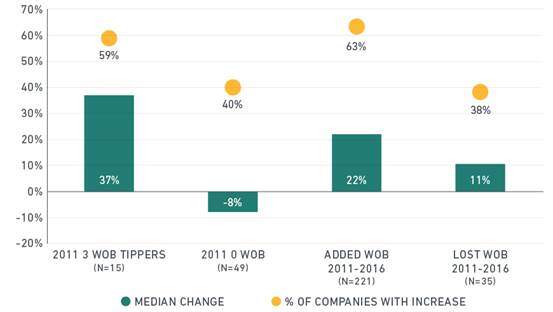

Five-Year Earnings Per Share (EPS) by Number of Women Directors

Source: MSCI ESG Research

The chart compares the five-year EPS performance of four groups of companies: 1) those that reached the “tipping point” of three women on the board (WOB) in 2011; 2) those that had zero women on the board in 2011; 3) those that added any number of women between 2011-2016; and 4) those that lost any number of women between 2011-2016.

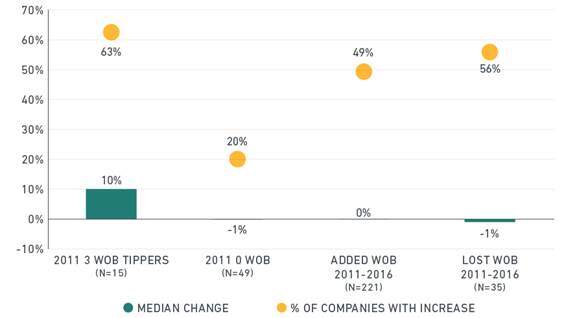

Five-Year Return on Equity (ROE) by Number of Women Directors

Source: MSCI ESG Research

The chart compares the median five-year ROE change (in percentage points) of four groups of companies: 1) those that reached the “tipping point” of three women on the board (WOB) in 2011; 2) those that had zero women on the board in 2011; 3) those that added any number of women between 2011-2016; and 4) those that lost any number of women between 2011-2016.

Such superior performance from companies with at least three female board members may derive from better decision-making by a more diverse group of directors, as some studies hypothesise. But out performance may also be tied to greater gender diversity among senior leadership and the rest of the workforce, which has been correlated with reduced turnover and higher employee engagement.

Globally, we found that large multinational companies that had a critical mass of female directors tended to have more gender-diverse leadership teams and were more likely to have a female CEO. We also found that such companies were more effectively tapping available female talent supplies throughout the organisation. Thus, the presence of at least three women directors may be seen as a doubly positive indicator: of a better-performing company and of a more functional organisation overall. In short, having more women directors may lead to a virtuous cycle.

Written by Linda- Eling Lee, the Global Head of ESG Research.

The author thanks Meggin Thwing Eastman, Damion Rallis and Gaia Mazzuchelli for their contributions to this post.

Environment12 months ago

Environment12 months agoAre Polymer Banknotes: an Eco-Friendly Trend or a Groundswell?

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Features12 months ago

Features12 months agoEco-Friendly Crypto Traders Must Find the Right Exchange

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future