Features

We need investment to return to its ‘patient evolutionary path’

Capitalist lore states that shareholders have more concern for the long-term interests of companies they invest in than managers do. The increase in high frequency trading (HFT), following big bang and advances in computing, has disconnected investment from its core purpose. Businesses need capital and in return deliver income and asset growth for investors.

Dictionaries describe investment as, “The action or process of investing money for profit or material result”, and, “A thing that is worth buying because it may be profitable or useful in the future.”

Speculation is more complicated to define because some sources say that speculation is simply a higher risk form of investment. Others define speculation more narrowly as positions not characterised as hedging – an investment position that offsets potential loss. Others define speculation as a damaging form of investment that disconnects investors from the companies invested in.

The whole spectrum clearly exists, from the person investing for the future in a company they understand and find attractive as a proposition. At the other end, you have the investor who hands their money over to a computer algorithm and trades purely for short-term gains. The former is the original purpose of investment; the latter more akin to a casino.

“When we own portions of outstanding businesses with outstanding managements, our favourite holding period is forever”, wrote Warren Buffett to Berkshire Hathaway shareholders in 1988. Based on global stock turnover ratio, most listed businesses fall far short of being outstanding or run by outstanding management.

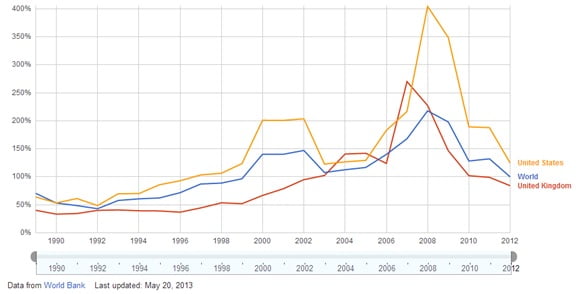

Stocks held for less than four months in UK and USA

The World Bank defines the stock turnover ratio as, “The total value of shares traded during the period divided by the average market capitalization for the period. Average market capitalisation is calculated as the average of the end-of-period values for the current period and the previous period.”

If a company was worth £100 and the total value of shares traded in that company was £100, then the stock turnover ratio was £100%. This means the total value of the shares traded equals the value (market capitalisation) of the company.

Stock turnover ratio.

The pre-crash peaks of 270% turnover in 2007 in the UK and 404% in 2008 in the USA, meant stocks were being held for just over four months and under three months respectively. As this was an average, some stocks were changing hands even faster. That hardly represents the long-term interest in a company’s future.

Andrew G Haldane of the Bank of England covered this in an excellent paper called Patience and Finance in September 2010. He illustrated the trend graphically.

David Hunkar of Seeking Alpha wrote shortly afterwards, “Based on the NYSE index data, the mean duration of holding period by US investors was around seven years in 1940. This stayed the same for the next 35 years. The average holding period had fallen to under two years by the time of the 1987 crash. By the turn of the century, it had fallen to below one year. It was around seven months by 2007.

David Hunkar of Seeking Alpha wrote shortly afterwards, “Based on the NYSE index data, the mean duration of holding period by US investors was around seven years in 1940. This stayed the same for the next 35 years. The average holding period had fallen to under two years by the time of the 1987 crash. By the turn of the century, it had fallen to below one year. It was around seven months by 2007.

“Similar pattern exists in the UK also as shown in the chart above. There the average duration has fallen from around five years in the mid-1960s to less than 7.5 months in 2007.

“Over the past 15 years even in international equity markets, holding periods have fallen. The Chinese market was red hot until few months ago. However the duration for the Shanghai stock market index is close to just six months. This shows that Chinese investors do not have a long-term horizon.”

The Bank of England’s Haldane went on to add the following: “A decade ago, the execution interval for HFTs was seconds. Advances in technology mean today’s HFTs operate in milli- or micro-seconds. Tomorrow’s may operate in nano-seconds.

“HFTs operate in size as well at speed. HFT firms are believed to account for more than 70% of all trading volume in US equities, 40% of volumes in US futures and 40% of volumes in US options. In Europe, HFTs account for around 30-40% of volumes in equities and futures. These fractions have risen from single figures as recently as a few years ago. And they look set to continue to rise.

“Asian is not immune from these trends. HFT is believed to account for between 5-10% of Asian equity volumes. In China, HFT is still in its infancy. But market contacts suggest as much as 80-90% of trading on the Shanghai stock exchange may be done by day-traders, many small retail investors. Impatience is socially, as well as technologically, contagious.

“This evolution of trading appears already to have had an effect on financial market dynamics. On 6 May 2010, the price of more than 200 securities fell by over 50% between 2.00pm and 2.45pm. At 2.47pm, Accenture shares traded for around seven seconds at a price of 1 cent, a loss of market value close to 100%. No significant economic or political news was released during this period.”

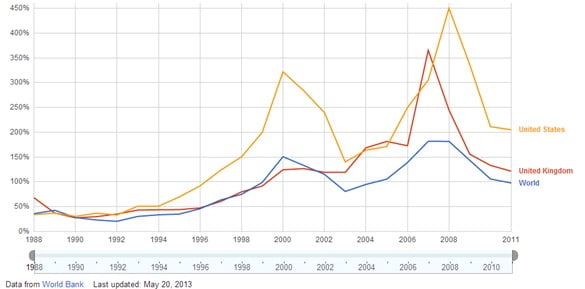

The World Bank also measures the total value of stocks traded as a percentage of GDP. Again, if global or a country’s GDP was £100, if the ratio was 100%, then the total value of stocks traded would be £100. In the UK, the value of stocks traded reached 365% of GDP in 2007 in the UK and 450% in 2008 in the USA.

Total value of stocks traded as a percentage of GDP.

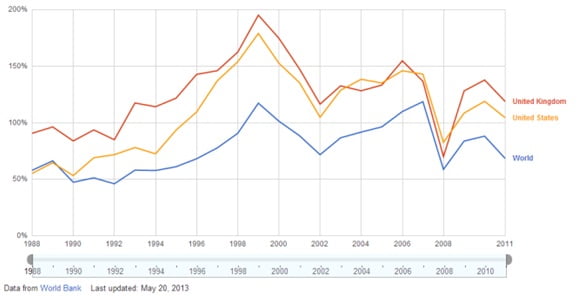

The World Bank also compares the market capitalisation of listed companies as a percentage of GDP. Again, if global or a country’s GDP was £100 then the total value of its listed companies would be £100, if the ratio was 100%.

Despite the speed of trades and growth in the value of trades, the actual market capitalisation of listed companies has been less extreme or volatile – apart from the dotcom boom and 2008 crash. While there will be some debate about whether this is a lost or underperforming decade, listed companies as a percentage of GDP market capitalisation of listed companies in 2011 remains at the same level as 1995.

Market capitalisation of listed companies as a percentage of GDP.

In conclusion, Andrew Haldane stated, “Just as patience can ward off great disaster, impatience can ruin a whole life. Generations of dieters and addicts are testament to that. So too is finance, not least in the light of the crisis. It is important finance sticks to the patient evolutionary path. To do so, the fidgeting fingers of the invisible hand may need a steadying arm.”

Further reading:

Transparency, simplicity and honesty is urgently needed in investment

Investors call for complete transparency over fees and charges

Financial advice industry ‘a long way from making things better’, as banks unveil charges

Ethical funds ‘exposed’ or the lesser of 3,000 evils?

Ex-Goldman Sachs director: unethical banking affects everyone

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy11 months ago

Energy11 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change