Economy

Directors enjoy “platinum-plated” pensions, TUC claims

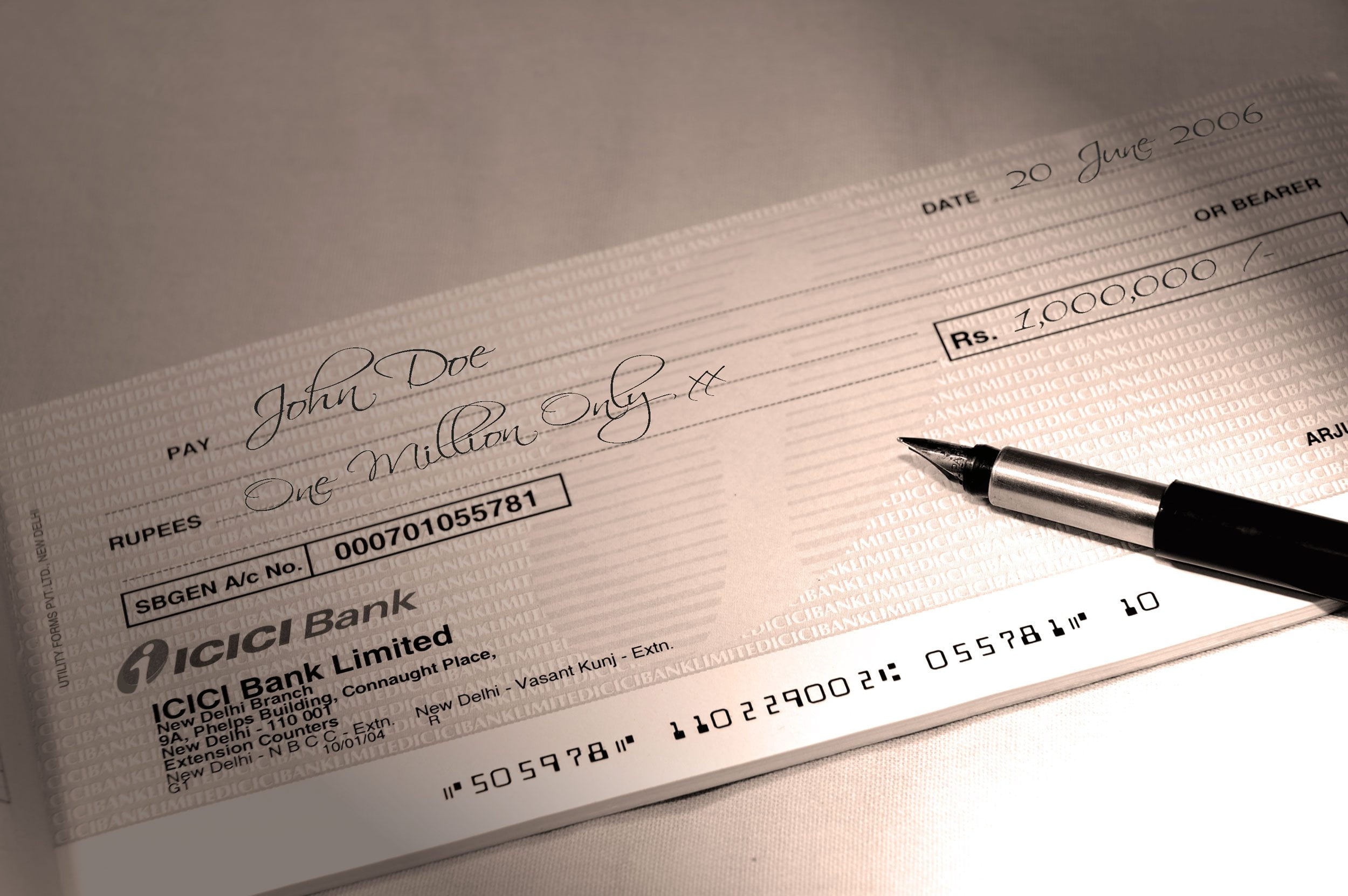

The Trade Union Congress (TUC) has spoken out against the luxurious increase of directors’ pensions, which are now 25 times higher than those of ordinary employees.

The TUC’s PensionsWatch 2013 report claims that the pension pot for directors of FTSE 100 companies has grown by £400,000 last year, reaching £4.73 million. It says that their average pension is now £259,947 per year, which is 25 times the usual pension of an employee (£10,452 a year).

TUC general secretary Frances O’Grady said, “For decades, companies have been telling employees that decent pensions are an unaffordable luxury. But these rules clearly don’t apply to those at the top”.

He added that as pensions are not performance-related, there should be no reason for such a huge gap. The TUC also argues that while receiving high pensions, bosses are also still able to stop working at 60, while the national retirement age is rising.

“Britain’s top bosses already enjoy a level of pay and bonuses beyond common decency. But not content with grabbing an ever larger slice of the UK’s earnings pie, they are adding to the country’s growing inequality with their platinum-plated pensions”, O’Grady added.

The report listed the top five directors earning the highest accrued pension, with Kirk Lanterman, director of cruise ship company Carnival Corp getting £1.2 million a year. He is followed by David Brennan of AstraZeneca, who has a pension scheme worth £1 million a year. Shell and BP directors stand in the fourth and fifth position, enjoying an annuity higher than £800,000.

“With millions of people joining workplace pension schemes over the next few years, this sharp divide will come under ever closer scrutiny. It’s time companies created a level playing field when it comes to their pension schemes”, said O’Grady.

Further reading:

Government must do more to make finance sustainable, say MPs

UK bankers are paid too much, says EU regulator

‘Shocking and widespread malpractice’ should land bankers in jail, says commission

Features11 months ago

Features11 months agoEco-Friendly Cryptocurrencies: Sustainable Investment Choices

Energy11 months ago

Energy11 months agoThe Growing Role of Solar Panels in Ireland’s Energy Future

Energy11 months ago

Energy11 months agoGrowth of Solar Power in Dublin: A Sustainable Revolution

Energy10 months ago

Energy10 months agoRenewable Energy Adoption Can Combat Climate Change