Features

Leave Your Taxes to the Experts

The entire subject of taxes can be incredibly confusing for most people. As complicating as it can be for the average person, it’s exponentially more complex for small business owners. Unless your small business is a law firm specializing in tax law or a tax accountant agency, you’re probably somewhat overwhelmed by the process of filing taxes.

Every year, it seems that new rules or tax codes are put in place and the overall process gets even more complicated. On top of that, the penalties for mismanaging your businesses taxes can be devastating. These high stakes make the already challenging process even more stressful. For that reason, it’s always a good idea to consider seeking professional guidance when addressing your small business’s tax situation.

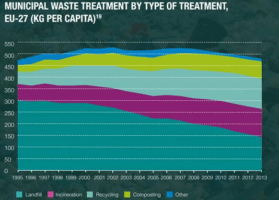

Changing Tax Laws

One of the biggest reasons you should seek professional help with handling your small business’s taxes is that tax laws seem to change every year. For example, at the end of 2014 there were several tax changes that began being implemented for 2015. First, there is the affordable care act which for many businesses (with some exceptions) went into effect in 2015. This new law has major ramifications on both healthcare for employees, as well as the responsibilities of businesses. And any company that is not in compliance with this law can face significant tax penalties.

To help simplify employment tax compliance (and minimize risk for your in-house payroll) consider the benefits of professional help, such as ADP Employment Tax & Compliance Services. It’s absolutely critical that your IT people consistently update the ERP business rules to accommodate multiple tax rule changes.

Corporate tax rates have changed too. With tax rates changing based on the type of business you have it is important to correctly incorporate your business and file taxes accordingly. There have also been changes to the deductions available to small businesses as well as the way investment income is taxed. In addition to these changes there are several other changes that have not yet even been decided upon, all of which effect the tax obligations of small businesses.

Why You Should Get Help

There are many reasons as to why it is preferable for small business owners to seek help in dealing with their tax situations. First, it allows you to focus on the important task of running your business as opposed to sifting through tax laws. Second, professional tax advisors can help you to plan ahead, making the entire process easier. Third, if there are any mistakes made on your taxes than having professional representation throughout the process will make everything less stressful. Finally, chances are that you are not trained in all the facets of filing taxes and tax law. So by using a professional that is trained in this area you are greatly reducing the chances of an error being made.

How to Get Help

There are many options small businesses should consider when looking for tax assistance. Obviously depending on the size and nature of the business, the firm’s in-house accounting department may be able to handle the companies tax needs. You can also contract out the work to a professional tax accounting company. If your business is small enough and you want to do some of the research on your own than you can look to the Small Business Administration’s website for specific information about your obligations.

You can also get specific information about your obligations from the IRS website. Both government websites also offer links to more resources to help you through the process. They can even help you to find high quality professional assistance that can do everything for you.

Taxes for Small Businesses

Given the fact that most small business owners are not also professional tax accountants, seeking professional assistance in dealing with your tax needs is always preferable. Choosing not to use professional help can lead to confusion, legal battles, and costly errors. If you are a small business owner then you should absolutely consider leaving the work of filing your taxes to the professionals, so that you can focus on the important task of growing your business.